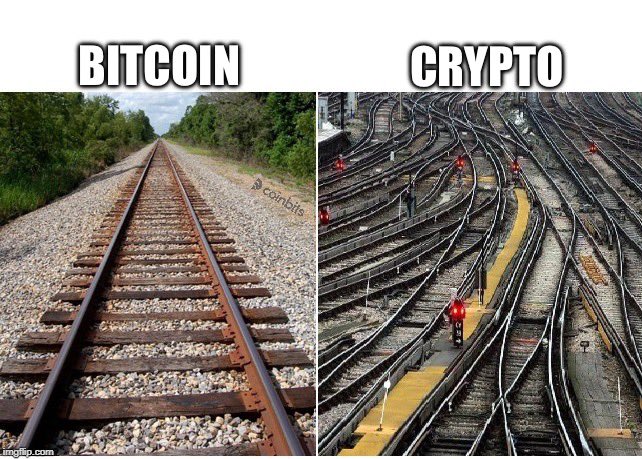

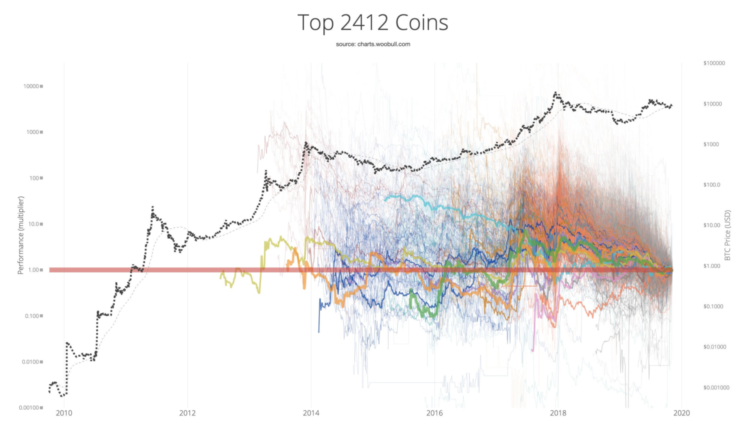

Hint: The above is true for Bitcoin only (not “crypto” in general), as you will see further down…

Get ahead of the curve, and discover…

- Why Bitcoin will rise forever against endlessly debasing fiat/$…

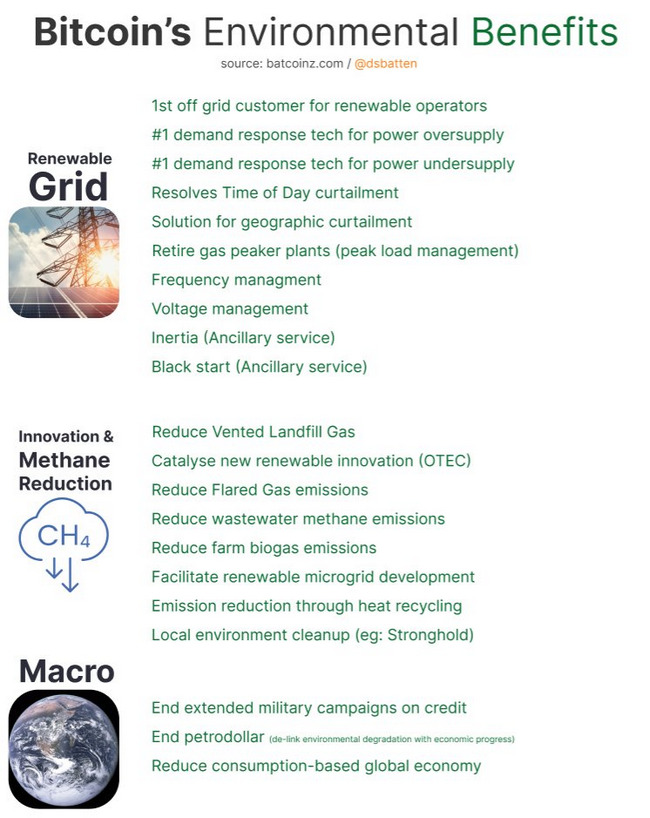

- How fanatical buyers/holders of last resort make Bitcoin a safe haven asset…

- Why Bitcoin is better for the environment the more energy it uses…

- How Bitcoin facilitates a mass self-empowerment global quantum leap…

- Why every “altcoin” is doomed (and why “alts” don’t compete with Bitcoin)…

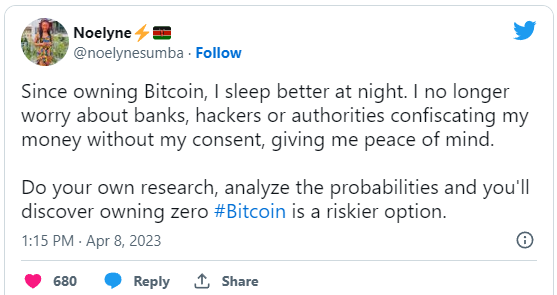

- Why holding zero Bitcoin is a far bigger risk than getting off zero…

- Why Bitcoin is a once-in-civilization early-bird opportunity…

Hit the ground running by watching this brief 1:45 “Bitcoin Trailer” before reading on…

Watch this video on YouTube

![]()

![]()

Firstly,

Energy and money are the two fundamental layers of our civilization.

Now…

Imagine a single innovation that revolutionizes both energy and money (in ways that are massively beneficial to 8+ billion people).

Factor in that…

98-99% are clueless about this fact – yet…

Right now…

That’s Bitcoin in a nutshell for you:

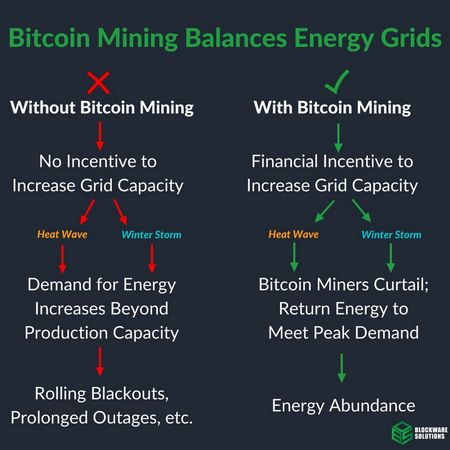

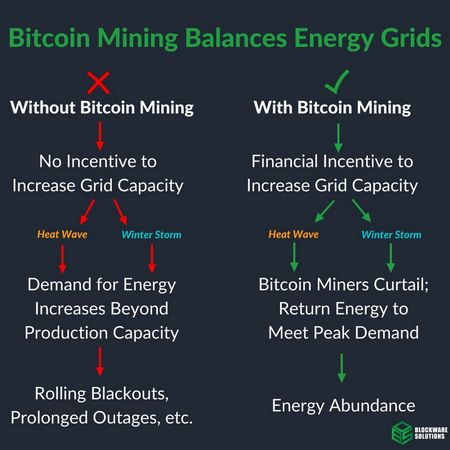

source: https://blockworks.co/news/bitcoin-mining-mitigate-power-shortages-texas

BREAKING: The Texas House & Senate have passed House Bill 591, clarifying that flared gas can be used on site by #Bitcoin miners, reducing carbon emissions by up to 63% 🙌

— Bitcoin News (@BitcoinNewsCom) May 10, 2023

Former leader of Texas’ energy grid, Brad Jones, says; “Bitcoin mining is helping balance our grid and is driving more renewables into our system.” (1-minute video):

source: https://arcane.no/research/reports/how-bitcoin-mining-can-transform-the-energy-industry

source: https://www.nasdaq.com/articles/new-hampshire-energy-commission-pushes-for-bitcoin-partnerships

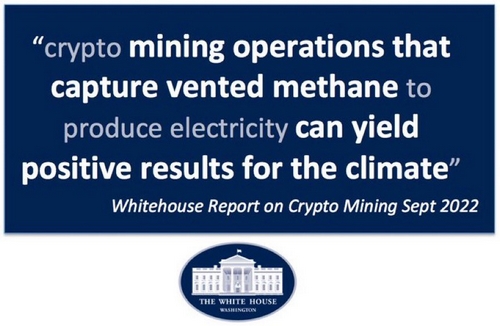

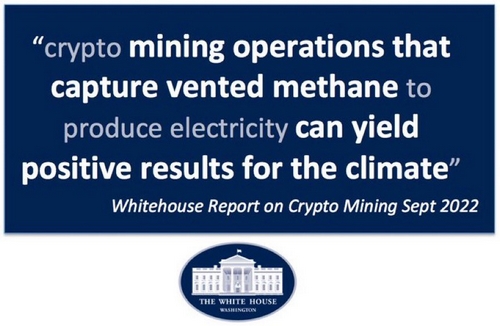

source: https://www.whitehouse.gov/wp-content/uploads/2022/09/09-2022-Crypto-Assets-and-Climate-Report.pdf

source: https://gridlesscompute.com/

source: https://www.tepco.co.jp/en/pg/about/newsroom/press/archives/2022/pdf/220921e0101.pdf

source: https://www.cnbc.com/2022/03/26/exxon-mining-bitcoin-with-crusoe-energy-in-north-dakota-bakken-region.html

Indeed, just check the video below…

Watch this video on YouTube

To sum it up:

This is why Bitcoin (money forged by energy) is the investment opportunity of a lifetime…

That being said…

It’s only a matter of time until “everyone” catches up to this…

Then the early-bird opportunity will be long gone…

Before we go deeper into the above, also consider the following curiosity…

source: https://www.nytimes.com/2022/08/02/technology/crypto-bitcoin-maximalists.html

Despite all the recent economic uncertainty and chaos (2022/2023)…

Bitcoiners remain happy, calm, and optimistic about the future…

This strong conviction and bold optimism may seem strange to outsiders.

The truth is…

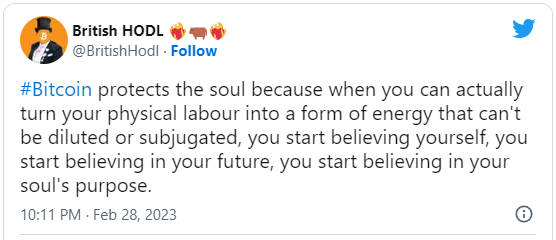

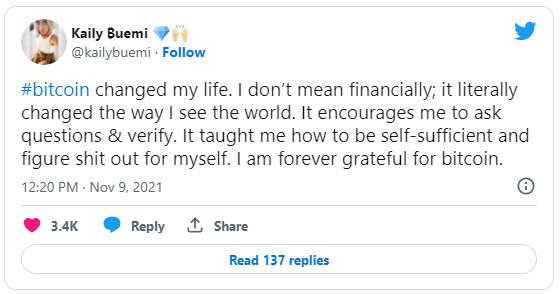

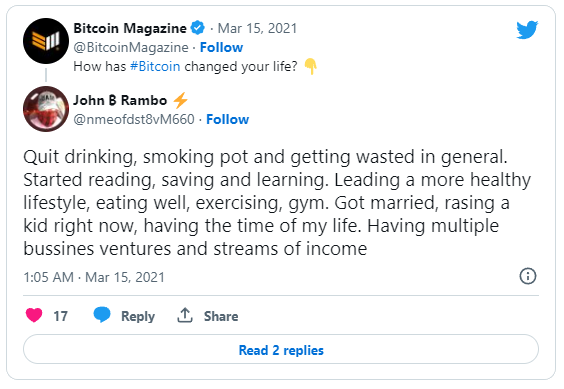

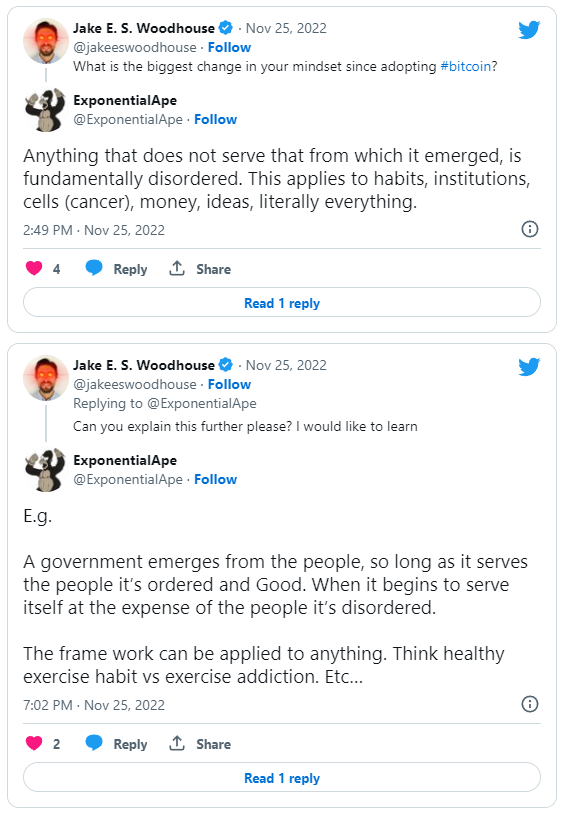

Bitcoin has a transformative effect on far more than just your economic situation…

It may surprise you to learn that…

Bitcoin sharpens your awareness in ways that will affect every aspect of your life…

How does this work, exactly?

As you already understand from the above…

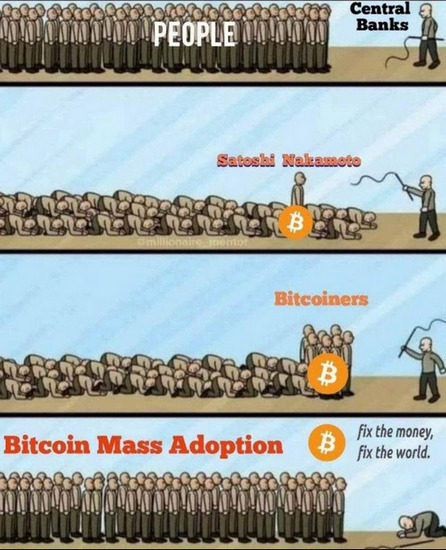

Bitcoin is a paradigm-breaking innovation…

We had the gold standard/paradigm before the two World Wars, which kept government spending in check.

Then…

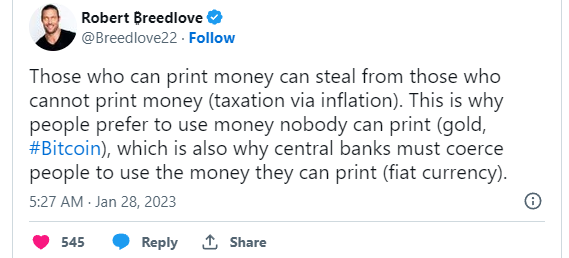

The unrestricted fiat standard/paradigm fueled “the century of war”…

World War I effectively ended the real international gold standard. (source: https://www.britannica.com/topic/money/The-decline-of-gold)

Under hard money, governments fought till they ran out of their own money. Under easy money, governments can fight until they completely consume the value of all the money held by their people. (source: https://www.rt.com/business/452445-fiat-hard-money-wars/)

And now…

The Bitcoin Standard/Paradigm is emerging for a Golden Age of peace and prosperity…

You see…

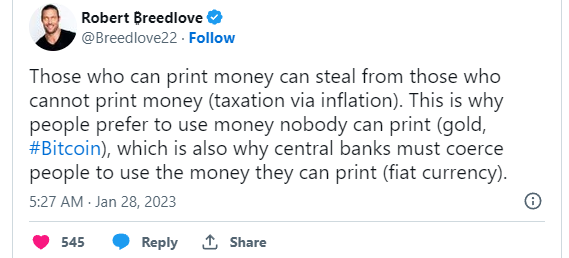

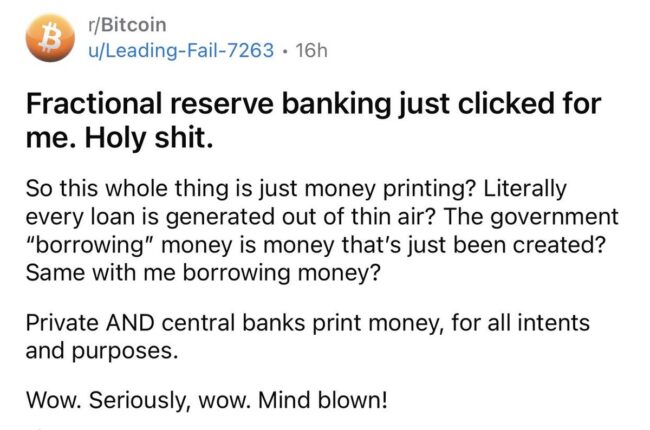

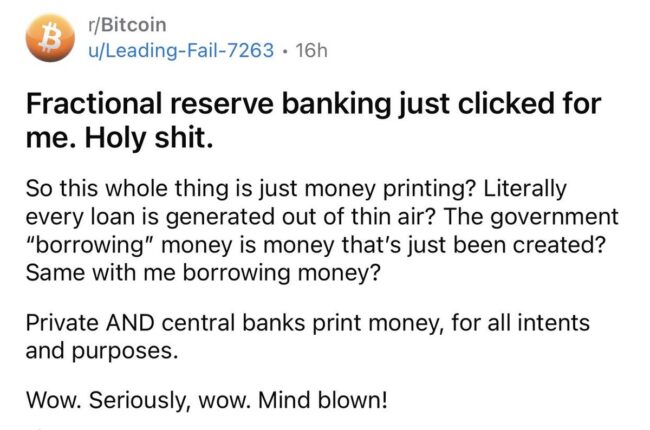

Bitcoin naturally exposes all the corruption and weaknesses of the current fiat paradigm (of endless money printing/debasing)…

It does so by merely existing, doing its thing, and being studied and contemplated by millions of people worldwide.

The deeper you dig into Bitcoin, the deeper you automatically go in yourself…

It grinds away indoctrinated, limiting fiat paradigm believes that never served you, nor humanity, in the first place…

Thus…

Bitcoin turbocharges your self-empowerment process, and eventually it upgrades your whole paradigm.

It makes you more self-reliant, independent, and it gives you a laser-focused BS detector…

In addition…

Bitcoin gives you a worthy cause to believe in – a purpose – which means you automatically start believing in yourself again…

In short…

Bitcoin builds your confidence, and makes you feel more whole, fulfilled, and content in your life.

All this comes naturally just by learning about Bitcoin, but it gets supercharged once you to take ownership.

Simply put…

Bitcoin is silently empowering people by its mere existence…

Think I’m joking?

Check what all these people have to say:

“Bitcoin changed my life…”

“Bitcoin gives meaning to my life…”

“Bitcoin make me feel more secure…”

“Bitcoin inspires hope for a brighter future…”

“Bitcoin gives me hope for my grandchildren…”

“Bitcoin made me grow, learn, and help others…”

“Bitcoin made me adopt a healthier lifestyle…”

While most self-help gurus charge you tons of money for life advice you never use…

Bitcoin gives you the soundest/hardest money fiat can buy…

Set aside only 25 minutes for this life-changing exploration, and a new and more enlightened version of yourself will come out on the other side – guaranteed.

Everyone can agree that we need sound, incorruptible money, so Bitcoin is a great uniter that transcends ideological differences…

Why You’re Getting This $499 Bitcoin Masterclass Totally Free Of Charge…

Everything you need to change your life in amazing ways is provided right here.

However, you do need to commit your full attention to it for a brief while.

Bear in mind…

I could easily sell this as a $499 Udemy Bitcoin Masterclass, and maybe I will put up a paywall at some point…

…as I’ve condensed more than 1,500 hours of deep study down to the essence for you.

However, you get it all free of charge for the time being, and…

I’ll explain why…

You see…

Bitcoin is perhaps the only thing that’s universal and fundamental enough to unite all of humanity.

When you become a bitcoiner…

You’re incentivized to serve the Bitcoin Network, just like it serves you and everyone else…

This is the hallmark of a healthy organism…

Your mindset changes from short-term greed to “how can I help”…

Now…

Imagine a world where 10% has this mindset, then 25%… 55%… 75%… and finally all 8+ billion of us…

Bitcoin binds us all together as The Network Of Humanity, since bitcoiners have a natural incentive to help other bitcoiners.

Everyone needs a sound store of value, which is why Bitcoin can unite all of humanity…

It transmutes greed into what can be called “honest altruism”…

Namely altruism where serving a greater whole also serves you:

- Selfish reason/greed: Get Bitcoin cheap now, before the inevitable supply shock price explosion…

- Altruistic effect = Help speed up Bitcoin adoption, and upgrade humanity to the freedom paradigm…

Bitcoin is thus ushering in a whole new “golden age paradigm” of Mutually Beneficial Cooperation…

For this reason I have no trouble giving away this $499 Bitcoin Masterclass for free.

Will there be an offer at the end of this

mind-blowing exploration?

You bet!

Taking the orange pill, and plugging out of the “Fiat Matrix”, requires bold and decisive action on your part.

A mutually beneficial way to ease you into the Bitcoin Standard will be provided (hint: we both get free bitcoin).

Bitcoin will turn your life around for the better, as it has for so many people, so let’s start by understanding why…

Bitcoin Presents You With A Once-In-A-Civilization Early-Bird Opportunity

(At Least For A Limited Time-Window…)

Bitcoin is still early in a process known as “price discovery”…

To put it into perspective…

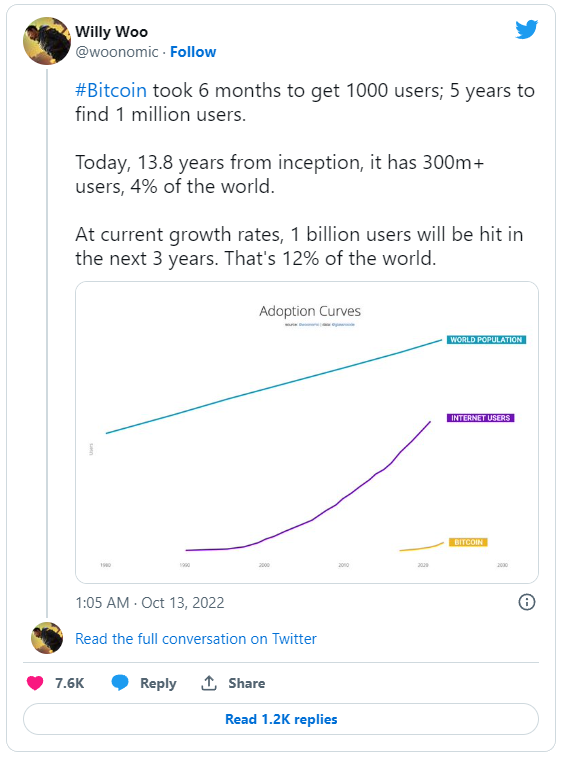

The Internet is 40 years old, while Bitcoin is only 14 years old (Q1 2023).

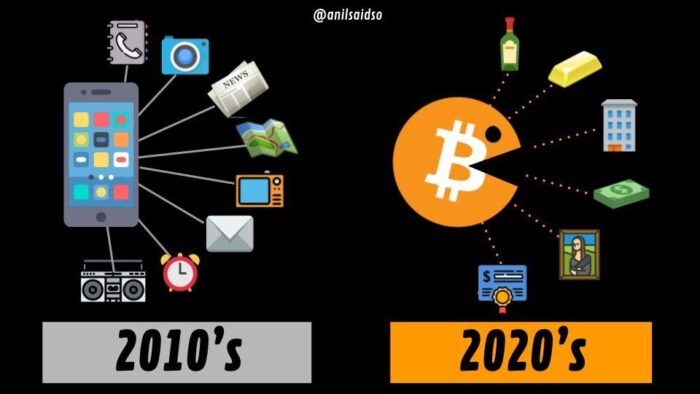

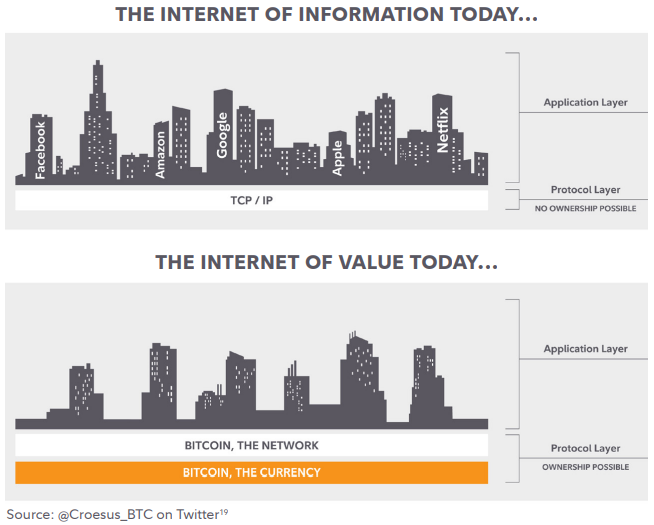

Investing in Bitcoin today is akin to investing in the TCP/IP protocol (if that was indeed possible) before Internet mass adoption.

It’s also akin to investing in premium domain names before institutions started hoarding them…

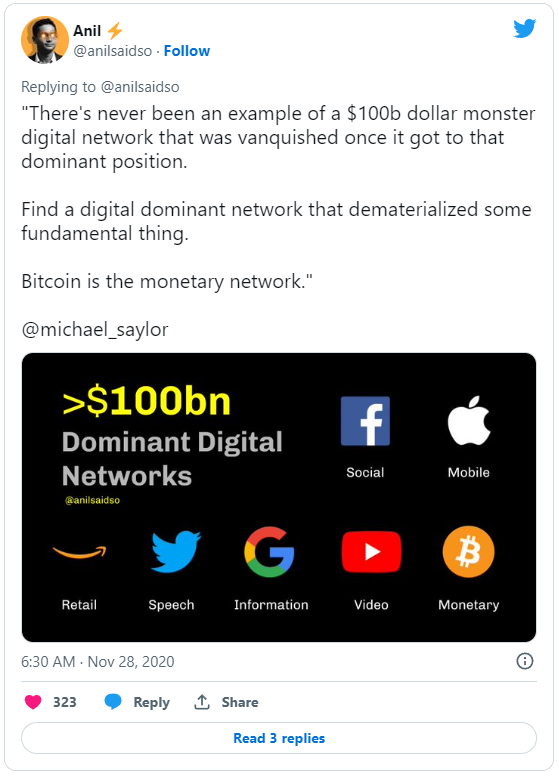

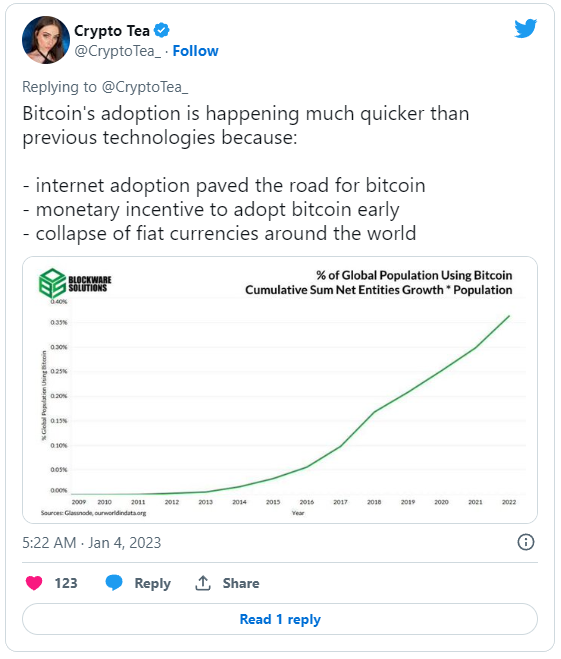

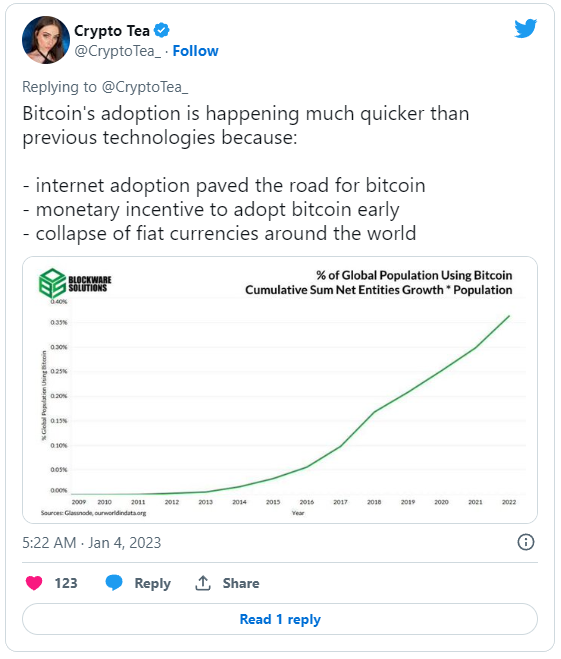

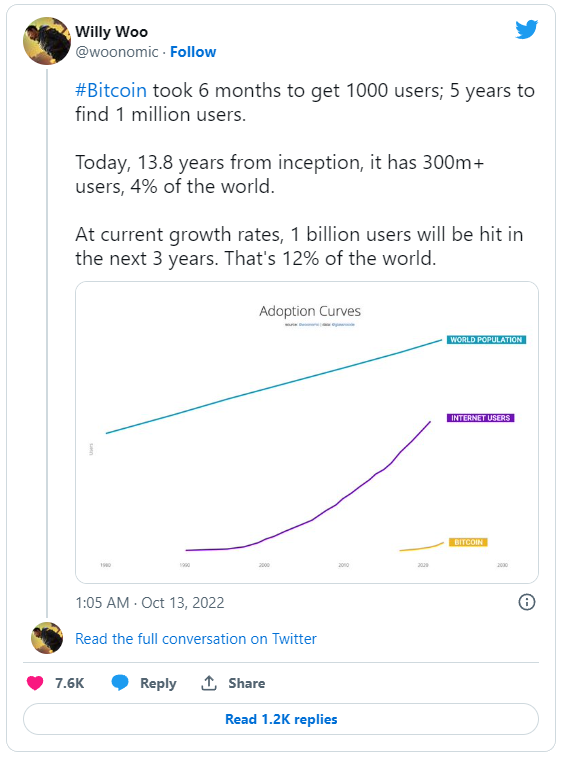

The Bitcoin Network is growing faster than Internet did though, which is natural since it basically adds a monetary protocol/layer to the Internet:

It’s safe to say that…

a tripling of the amount of bitcoiners over the next 3 years will have a massive impact on the fiat price…

Considering that…

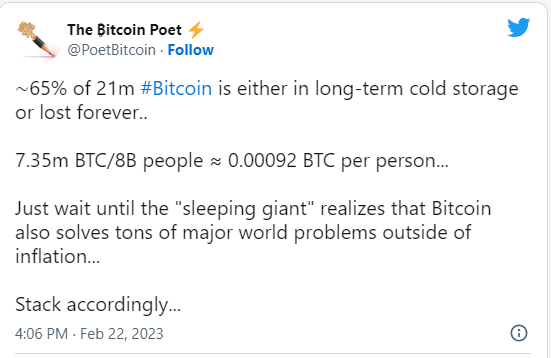

There will never be more than 21 million Bitcoin for 8+ billion people…

And the fact that…

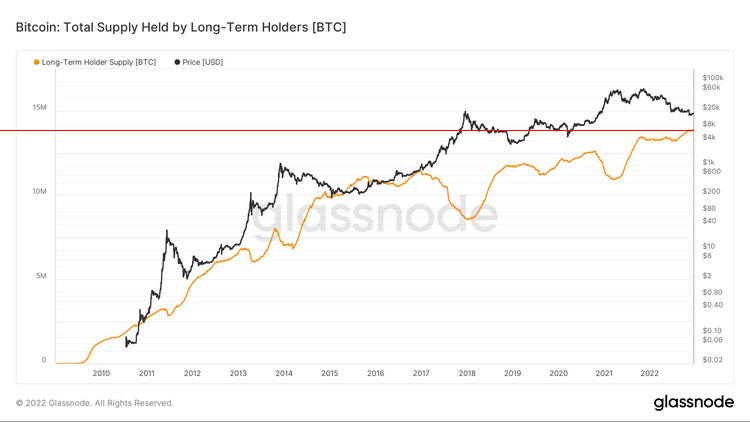

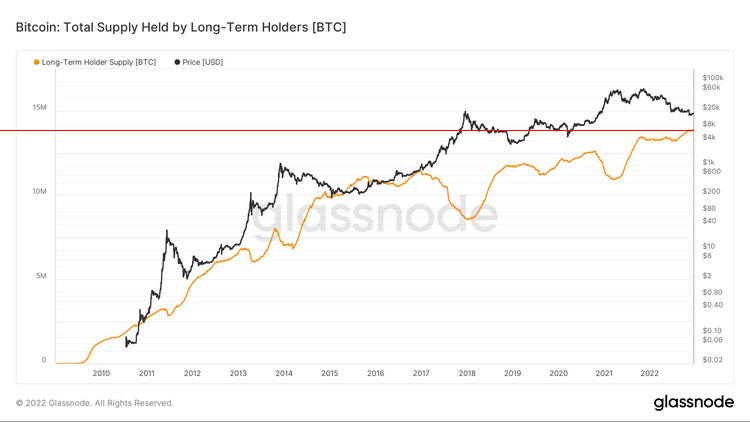

Long term holders already own around 67% of the total supply…

It’s only a matter of time…

until the supply shock skyrockets the fiat price…

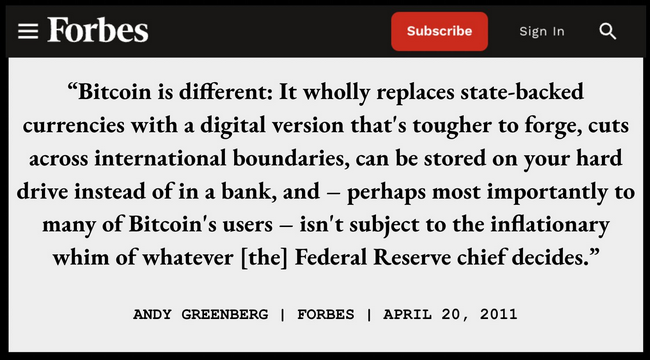

Okay, that all sounds great, but what is Bitcoin, exactly?

Watch this video on YouTube

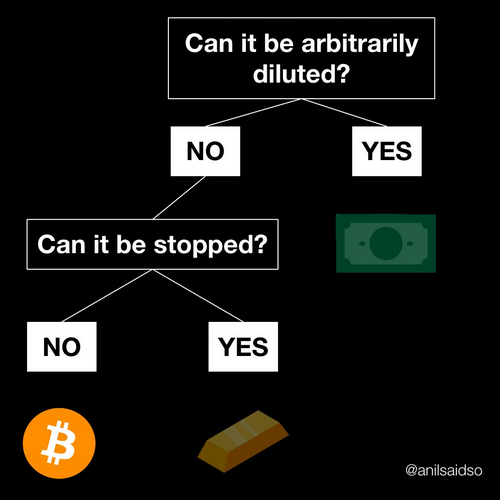

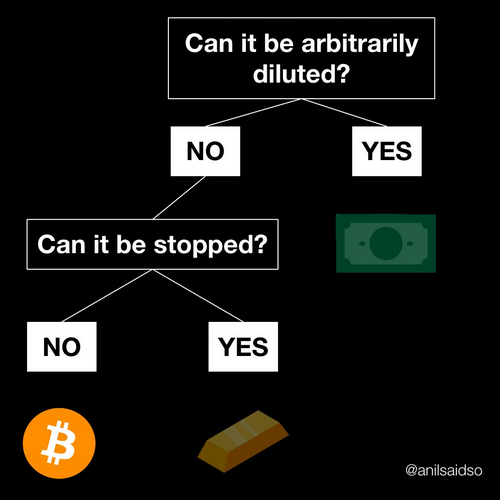

The 2 main problems Bitcoin was designed to solve are…

Fiat inflation/debasement, and trust…

Bitcoin also solves the following problems (for starters):

- Sending value to anyone anywhere with no possibility of censorship…

- Store-of-value technology also for the billions of poor and unbanked…

- Disrupts the money printer monopoly of the corrupt central banks…

- Creates an immutable monetary paradigm nobody can corrupt…

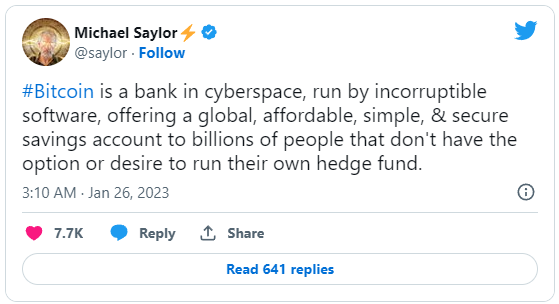

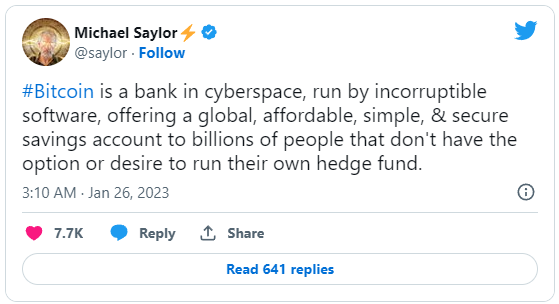

Boiled down to its essence…

Bitcoin is simply a global ledger (and monetary policy) that cannot be controlled, corrupted, or interfered with by anyone.

Here’s why…

Miners update the ledger every 10 minutes, and get paid in Bitcoin for doing so.

The sunk cost of mining equipment and spent electricity, as well as their BTC payment, gives the miners a strong incentive to follow protocol.

10,000-20,000+ full nodes run by individual Bitcoin enthusiasts (easy and inexpensive to do) verifies that the miners do indeed follow protocol.

And voila…

You’ve got yourself a global monetary settlement network (with a 100% predictable issuance policy) that nobody can interfere with…

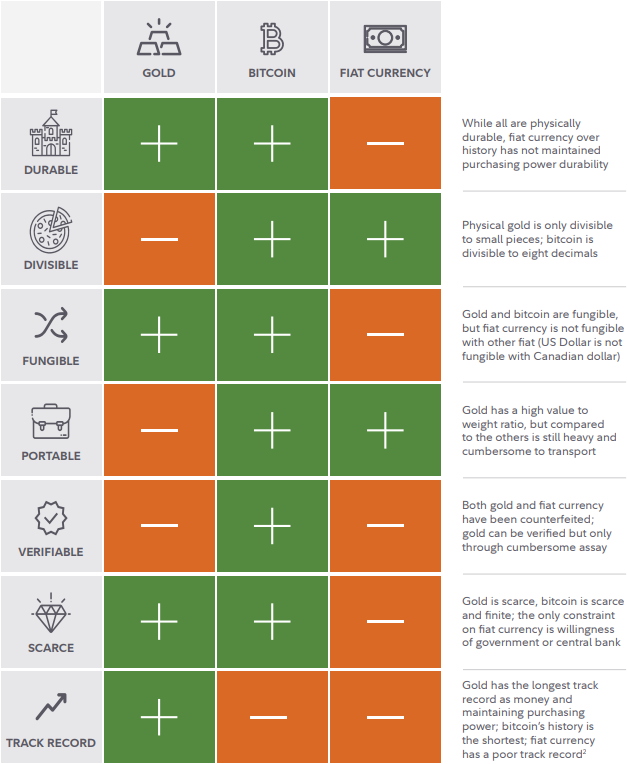

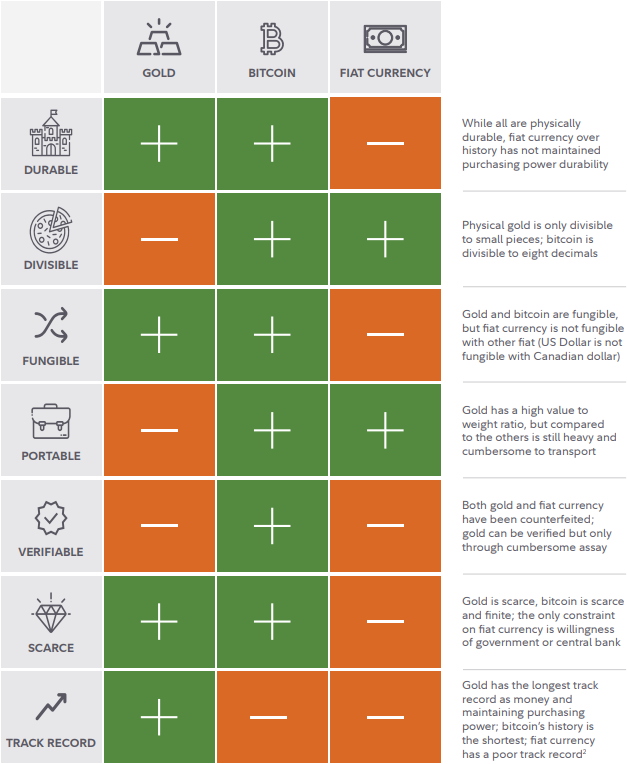

Bitcoin is close to perfect money (“track record” will soon be a non-issue):

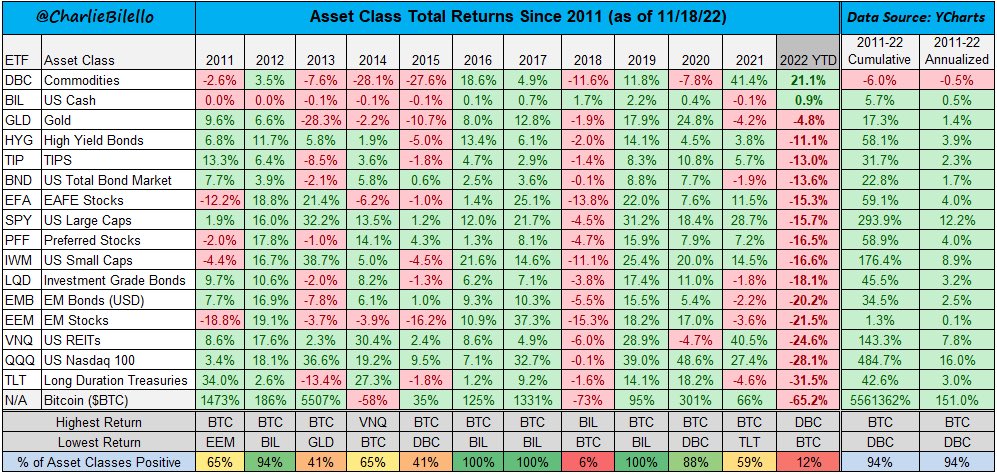

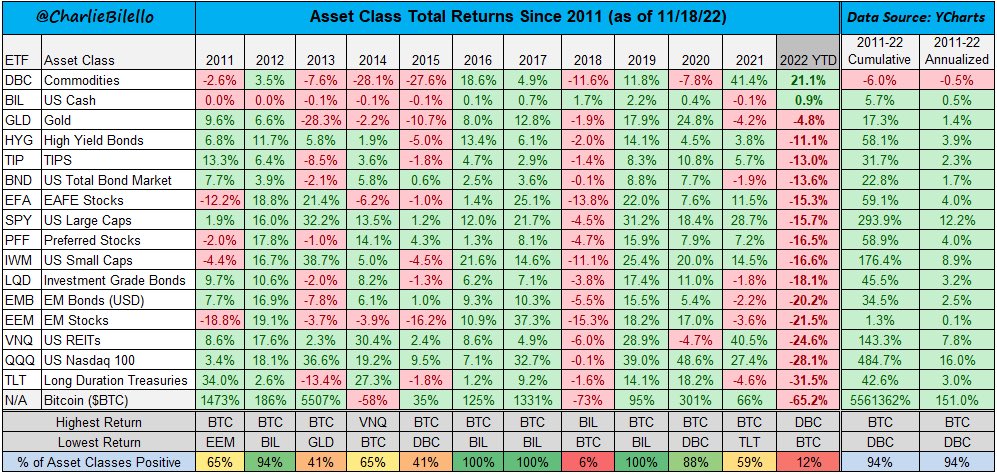

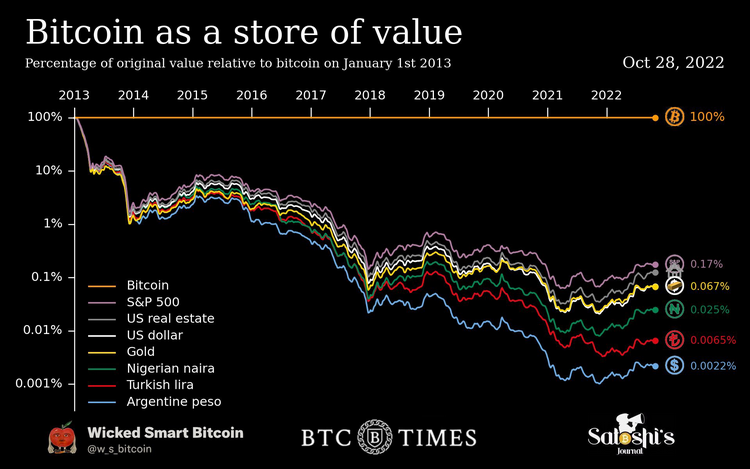

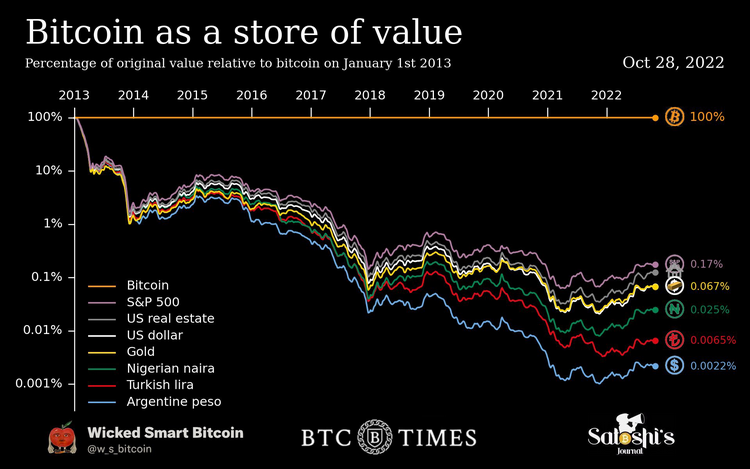

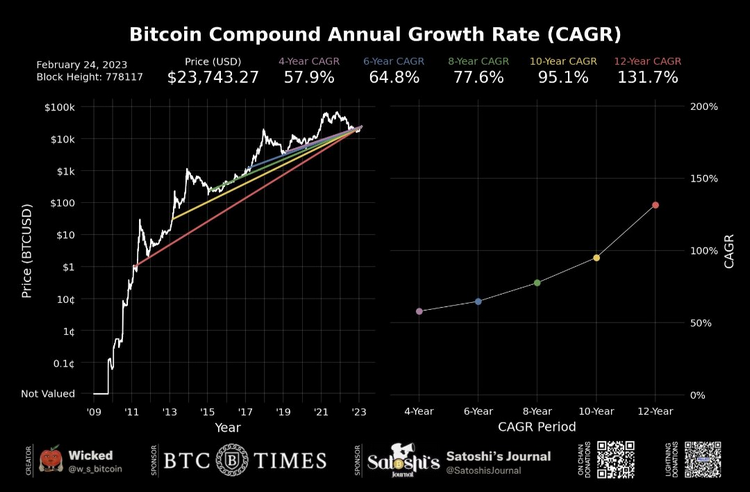

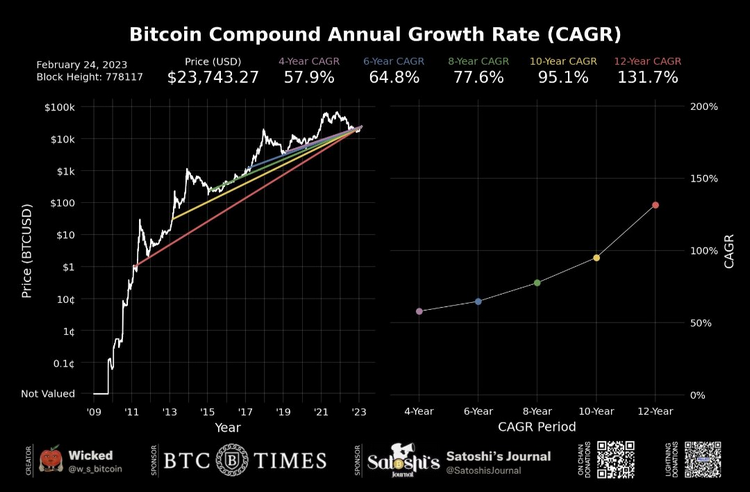

Here is how Bitcoin has performed compared to other asset classes the last decade:

The Bitcoin Network settled over $14T (with a T) in transactions in 2022 alone.

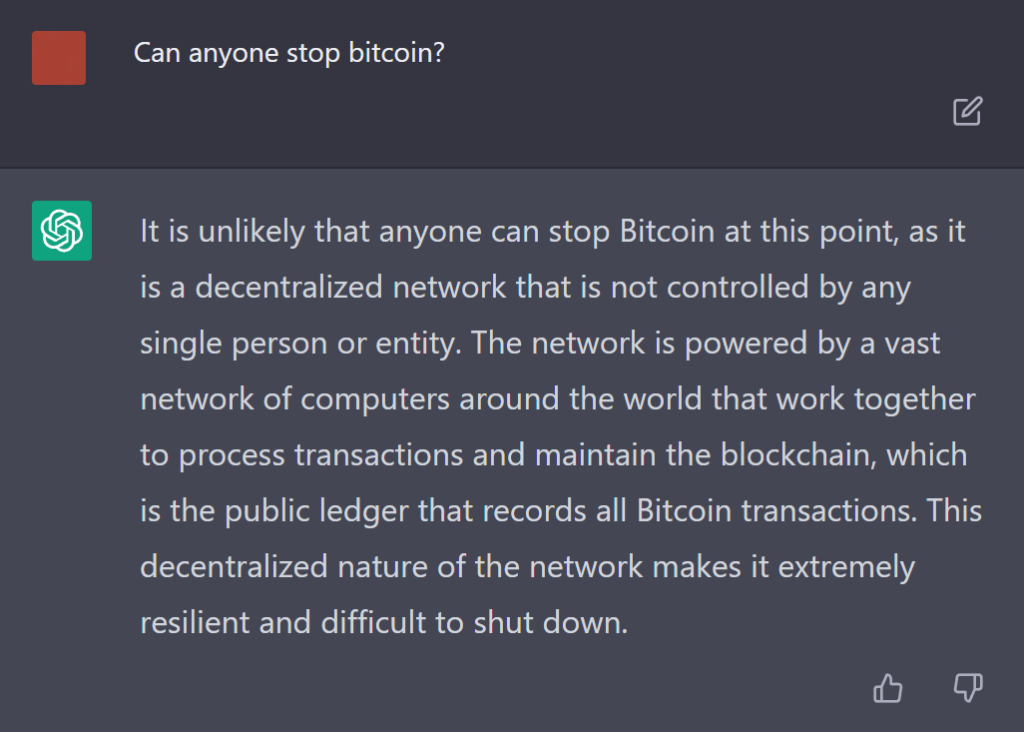

AI had this to say about whether or not Bitcoin can be “stopped”:

Sending Bitcoin to someone is akin to sending an email, except that Bitcoin cannot be copied or double-spent (think cut and paste, instead of copy and paste).

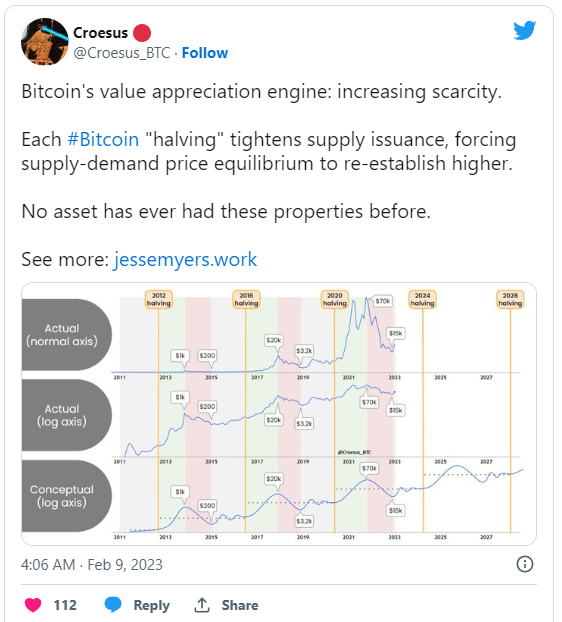

The final 21th million Bitcoin will be issued in year 2140, and the mining reward (i.e. the issuance of new BTC) is cut in half every 4 years:

It sounds simple enough, but it presents you with a once-in-a-civilization opportunity…

You see…

Monetized absolute digital scarcity cannot be re-invented/re-discovered…

In the words of former PayPal president, David Marcus;

Why?

You can copy the code, but not the network effect spanning over 14+ years…

Just like the discovery of the wheel, absolute digital scarcity cannot be re-discovered…

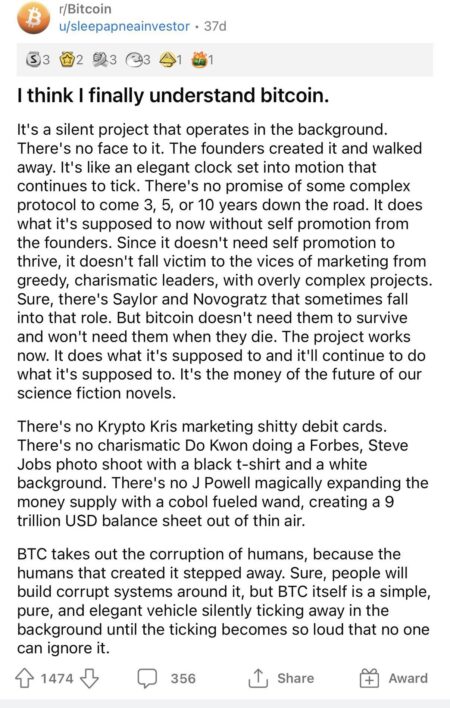

The one-time miracle of Bitcoin is precisely that it has grown into a world class asset WITHOUT a centralized founding group behind it.

This is why Bitcoin is broadly accepted as a commodity (also by regulatory agencies such as the SEC), while so-called “altcoins” are not (more about that soon).

Right Now, Bitcoin Hovers At The Perfect Golden Opportunity

Sweet Spot…

It’s a young, upcoming asset class, yet it’s mature enough to store between $400B to $1T in value…

That’s a 200x to 500x upside opportunity that will not exist forever…

But… what about the volatility?

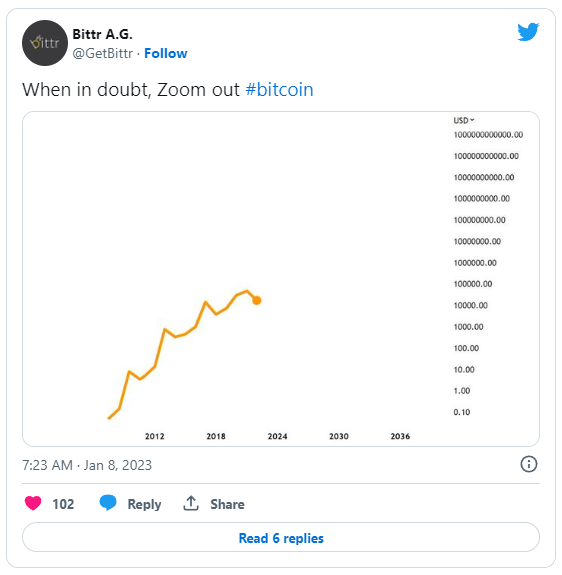

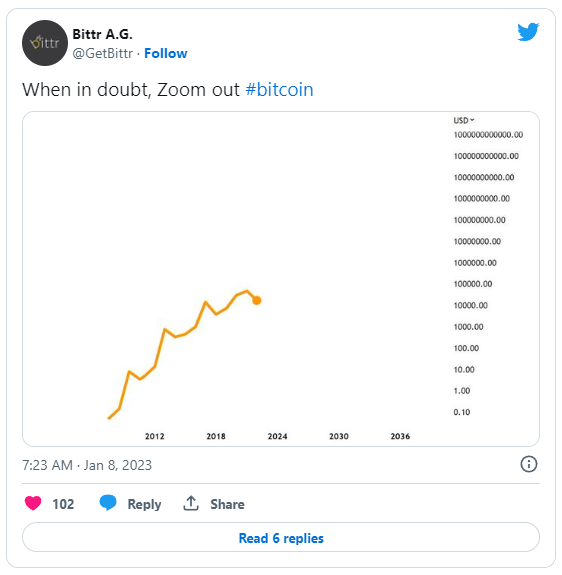

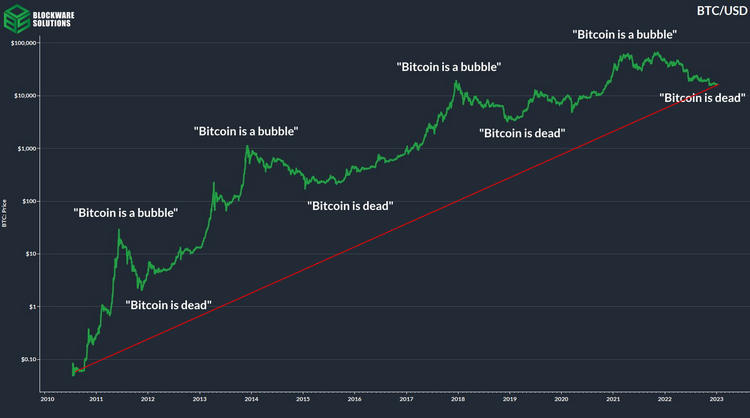

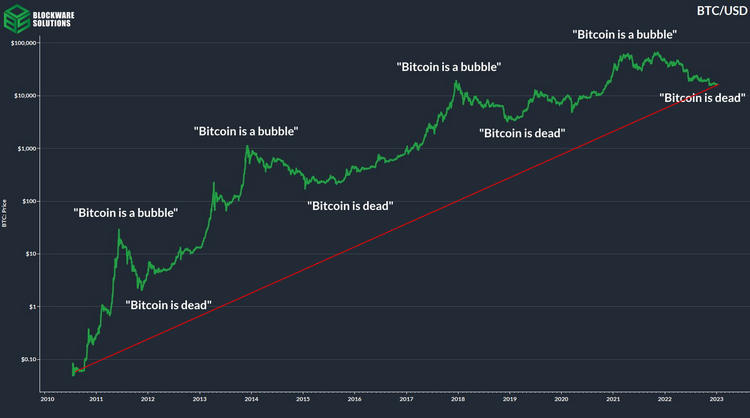

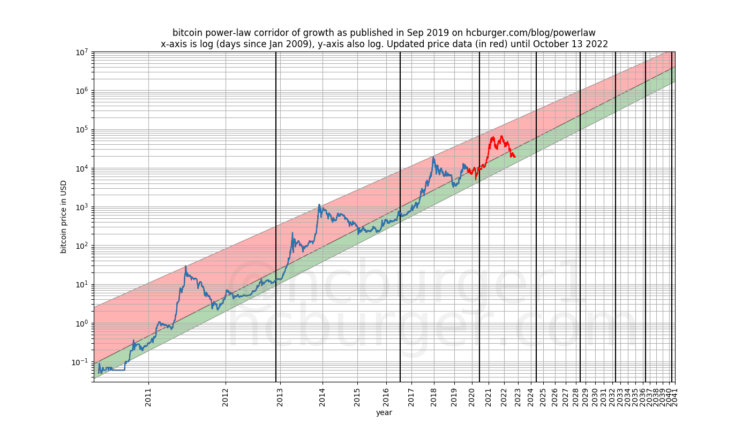

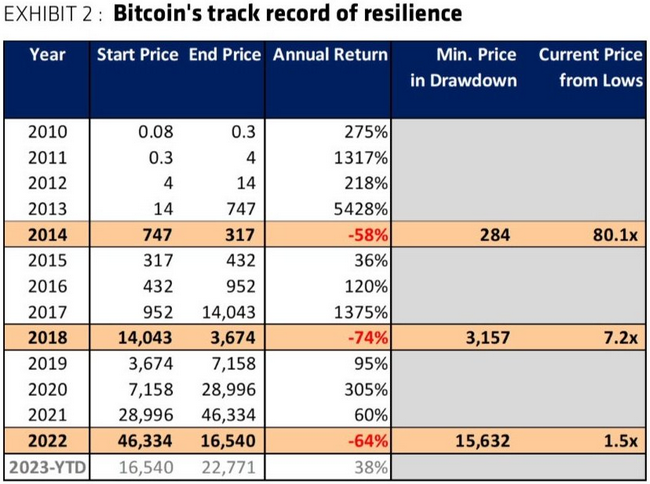

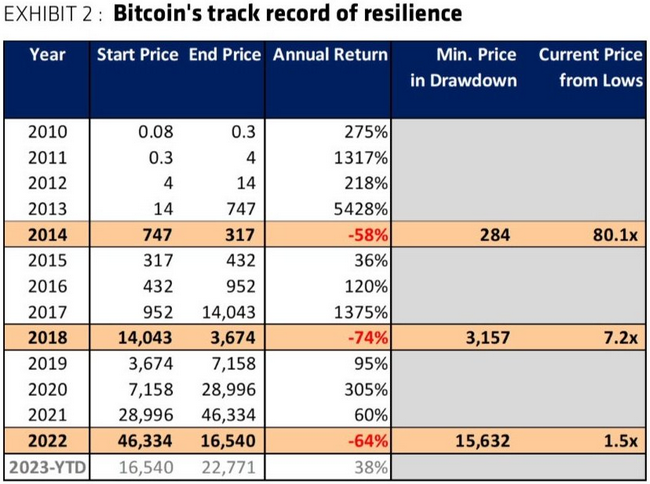

Bitcoin’s many ups and downs still points in one direction…

That being said…

It is true that the Bitcoin price measured in fiat is volatile…

It’s also true that every major bottom more or less matches the last top…

This makes Bitcoin a highly interesting investment opportunity, both short-term and long-term…

Most veteran bitcoiners see Bitcoin as a long-term store of value though…

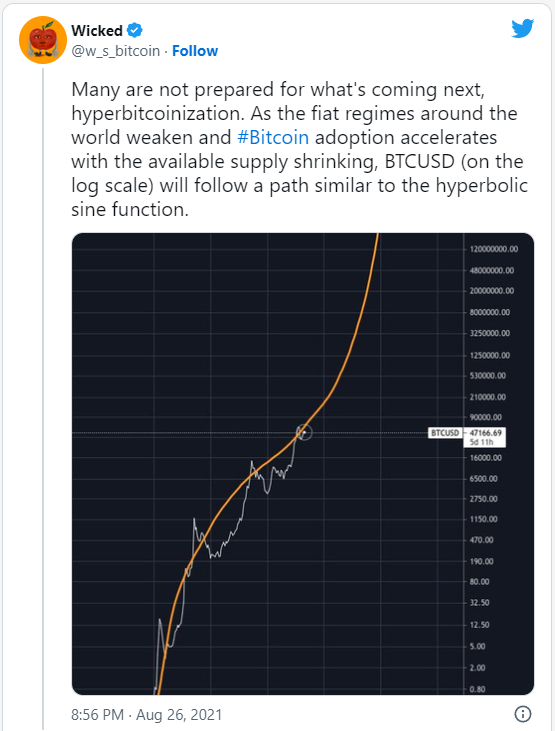

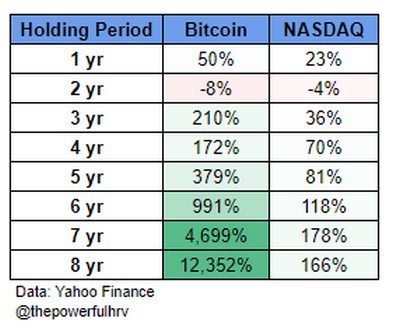

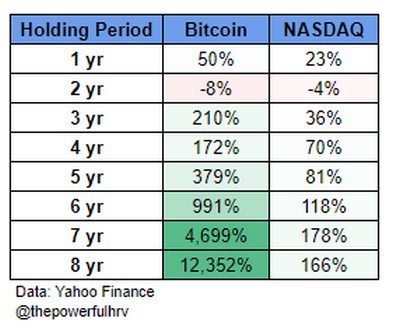

The graph below illustrates why:

Bitcoiners therefore celebrate every Bitcoin low, as it means they’re getting to buy at a discount…

The volatility will calm down once Bitcoin reaches the total value (market cap) of gold ($12T), and beyond…

The truth is…

Bitcoin is the most transparent, most stable, most secure, and most predictable financial instrument mankind has ever seen…

Bitcoin is for value what the atomic clock is for time, and for finance what the yardstick is for the construction business.

It’s a monolith of absoluteness in a chaotic, volatile world of human psychology…

…that flows forever between Fear Of Missing Out (FOMO) and Fear/Uncertainty/Doubt (FUD).

Bitcoin does its thing like clockwork:

Which is to produce a 100% reliable ledger updated every 10 minutes (with zero central or human control)…

But… Isn’t Bitcoin Just A Tulip Bubble That Can Pop At Any Time?

First of all…

The Tulip bubble never came back stronger time and time again, like Bitcoin does:

Secondly…

Bitcoin has a massive and growing bedrock of fanatical buyers and holders of last-resort…

These are long-term holders that buy any dip, which means…

Bitcoin is becoming ever-more scarce per major bear/bull cycle:

In the words of hedge fund billionaire, Stanley Druckenmiller (regarding the 2018 “crash”);

“I got a call from Paul Tudor Jones and he says; “do you know that when Bitcoin went from $17,000 to $3,000, that 86% of the people that owned it at $17,000 never sold it?”… So, here’s something with a finite supply, and 86% of the owners are religious zealots”.

source: https://bitcoinist.com/this-is-why-druckenmiller-and-tudor-jones-changed-their-mind-on-bitcoin/

Similar numbers are true for the insane macro-economic bloodbath that was 2022:

Despite the 75% “crash” of 2022, veteran bitcoiners have still outperformed most traditional investors by simply holding Bitcoin over the last 4+ years…

The volatility doesn’t bother veteran bitcoiners the slightest, which is a calm equilibrium Zen monks would admire…

The ups and downs carve out your diamond mind…

You simply keep exchanging endlessly debasing fiat for the scarcest asset in existence whenever you can…

The extreme fluctuations are actually good for you, and healthy for the space…

Why?

Volatility also clear out money/survival-related fears from your unconscious mind…

This is yet another example of how Bitcoin turbocharges your self-empowerment…

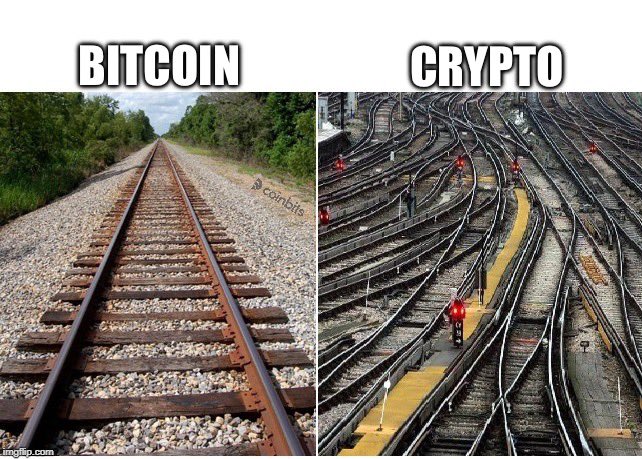

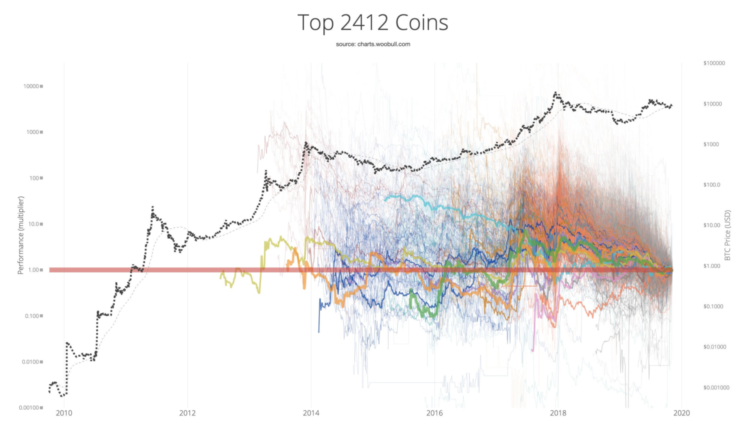

There are no alternatives to Bitcoin (as “altcoins” are centrally controlled soon-to-be-regulated-into-oblivion securities…)

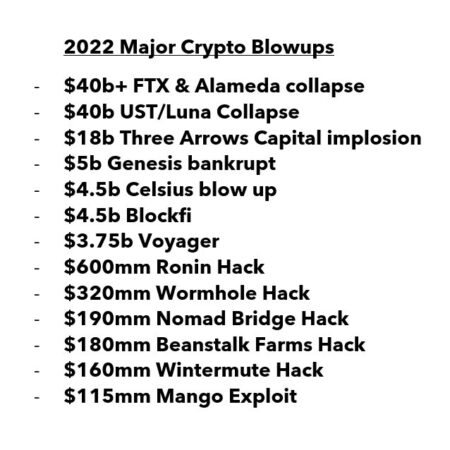

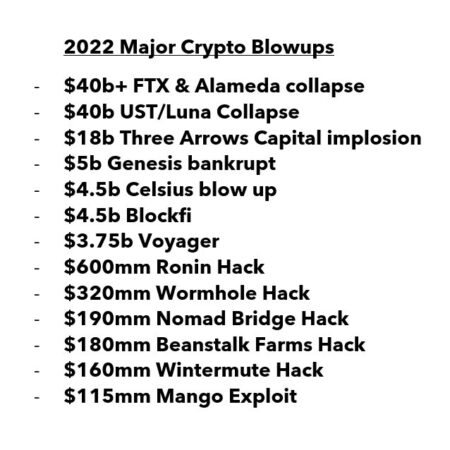

Bitcoin is predictable and established as a commodity, “alts/crypto” are a risky mess…

So-called “altcoins” are all centrally controlled and unregistered securities taking advantage of a brief window of regulatory arbitrage to scam newbies…

Measured against Bitcoin, all “alts” fade into oblivion given some time (see Bitcoin signal vs “altcoin” noise graph above).

“Alts” are hyped up at the start, as naive retail believe they have found “the next bitcoin”…

However, time and time again, the founders dump their pre-mined tokens on FOMO-frenzied retail, using them effectively as exit-liquidity.

All “alts” are controlled by an all-too-human single point of failure; namely the founding group.

A “blockchain” is just a slow, inefficient database when it’s centrally controlled:

A Blockchain is only worthwhile if the use case is eliminating the need for trust in a third-party, like Bitcoin does.

“Alts” are also on the verge of being regulated as what they have always been; securities…

Once that happens, the whole “free money printer for everyone” party is over…

The amount of required transparency and disclosure would be similar to a company going public, and not even Ethereum will survive that…

Both SEC Chairman, Gensler, and the CFTC Chair, Behnam, have dropped strong hints:

source: https://www.wsj.com/articles/ethers-new-staking-model-could-draw-sec-attention-11663266224

source: https://www.forbes.com/sites/mariagraciasantillanalinares/2022/06/27/sec-chairman-gary-gensler-implies-that-ether-is-a-security-and-falls-under-his-jurisdiction/

“US Securities and Exchange Commission (SEC) chairman Gary Gensler said Bitcoin was the only cryptocurrency he felt comfortable publicly calling a commodity in an interview with CNBC this afternoon.”

After the 2022 “altcoin” bloodbath (see above), it’s just a matter of time before “alts” will be regulated as what they are; securities…

Here is the Howey test (1946 US Supreme Court case, SEC v. W.J. Howey Co.) that defines what is or isn’t an “investment contract” aka a “security”:

- An investment of money

- in a common enterprise

- with the expectation of profit and

- to be derived from the efforts of others.

Seems clear cut to me at least, and…

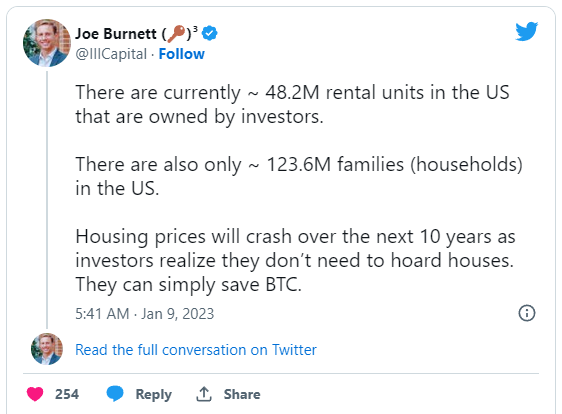

Here is what best-selling author of personal finance book, Rich Dad Poor Dad, said to his 2.3M followers in the middle of the 2022/2023 bear market low:

Institutional investors, smart money, and companies will probably want to stick with Bitcoin to avoid this regulatory nightmare as well…

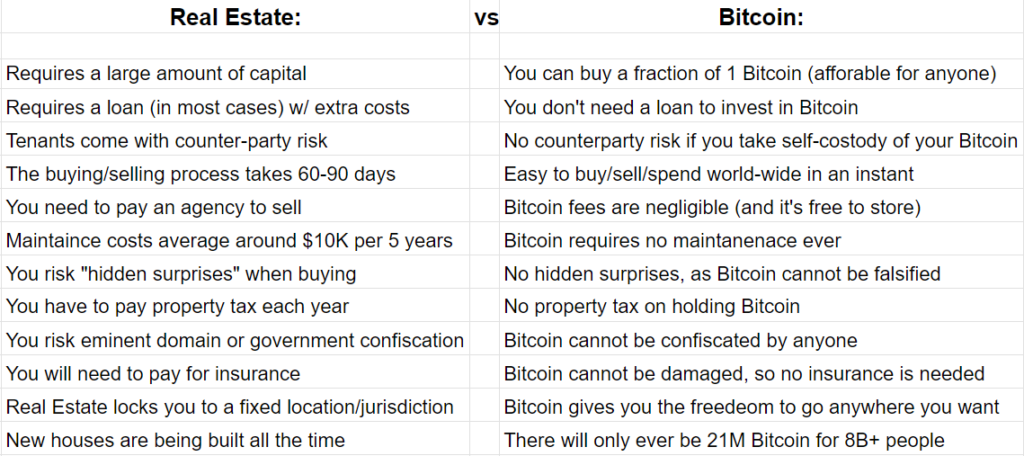

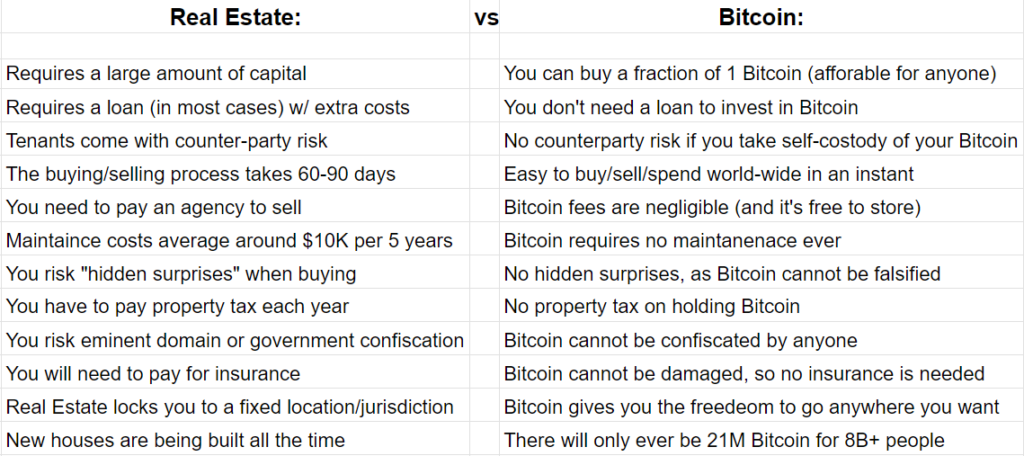

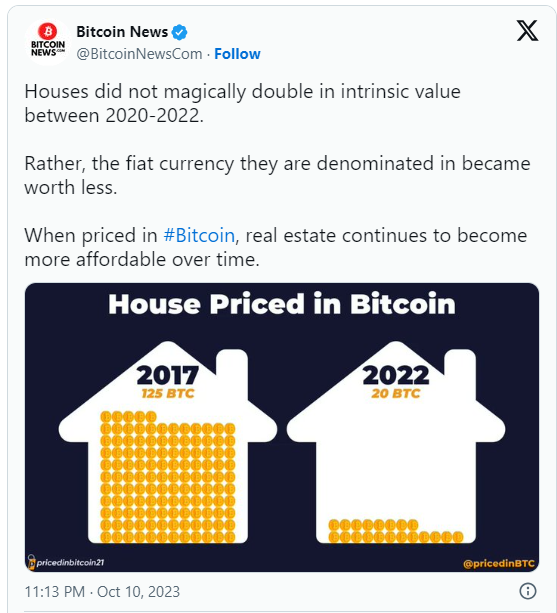

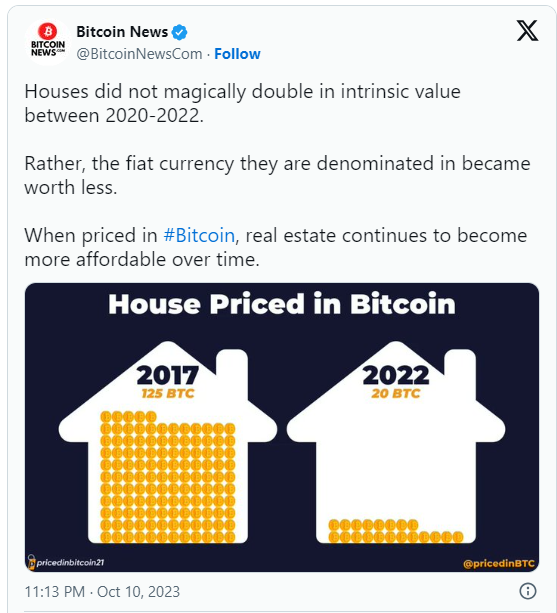

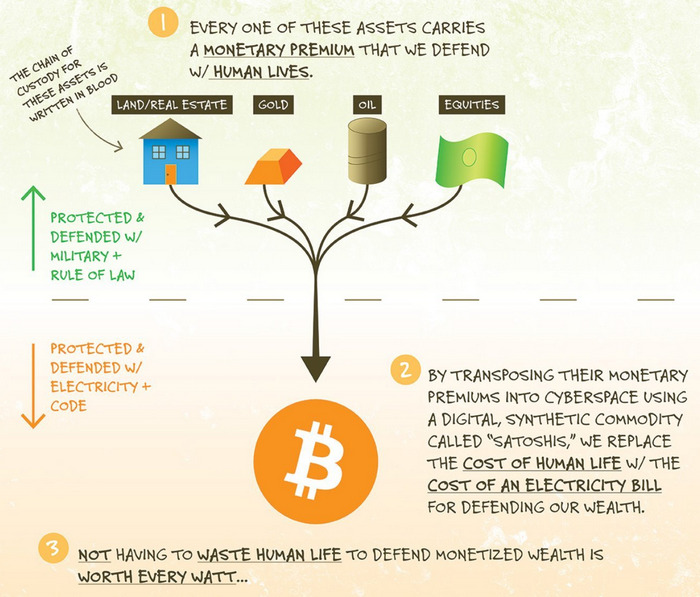

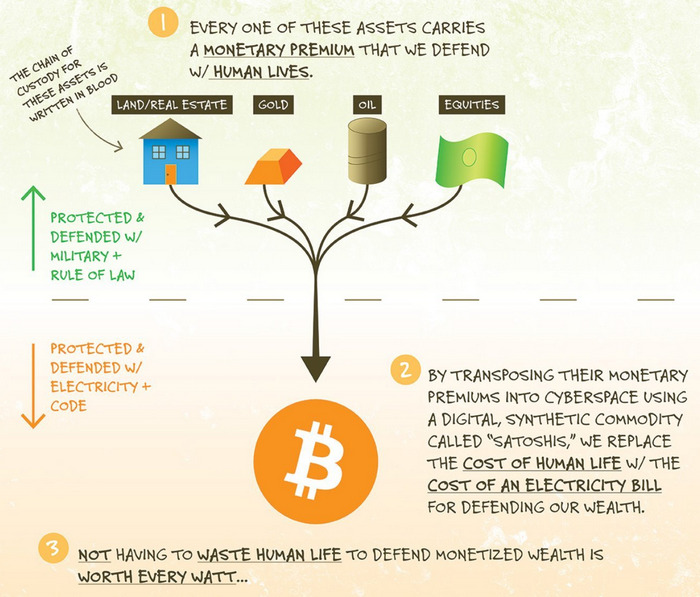

Bitcoin Is Digital Gold/Real Estate On Steroids, And Here Is Why It

Beats Both By A Country

Mile…

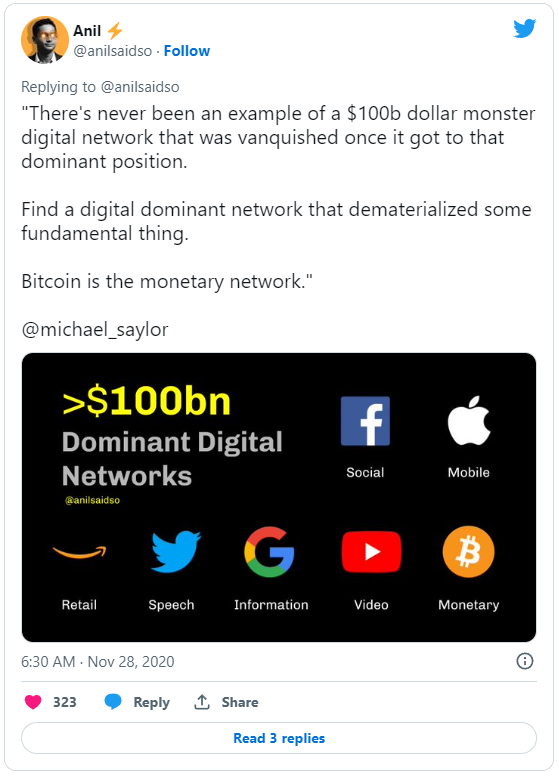

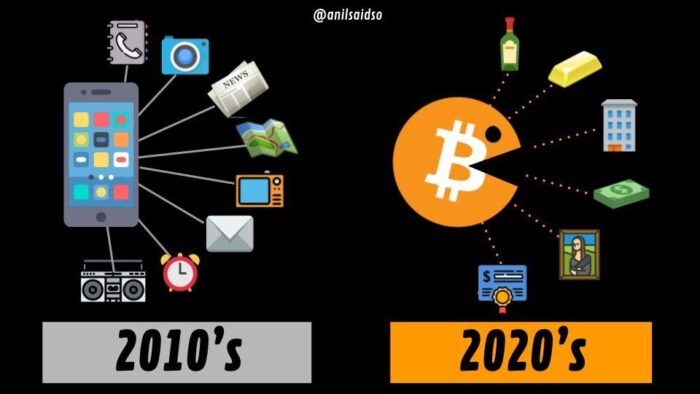

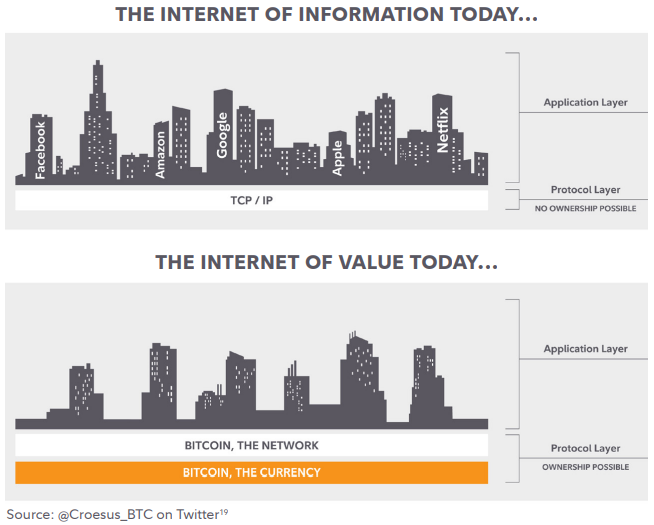

“Bitcoin is de-materializing store of value assets the same way that smartphones de-materialized consumer goods.” – @anilsaidso

Bitcoin is the biggest innovation since the Internet, and…

the vast majority are still in the dark about the fundamental ways Bitcoin is changing our world…

The Internet digitalized “everything” into the cloud: books (Kindle), music (Spotify), knowledge (Google), and the list goes on…

However…

Everything digitalized could also be copied and pirated endlessly, so for obvious reasons there was no functional digital money.

Satoshi Nakamoto changed all that on the 3rd of January 2009, when he unleashed the Bitcoin project…

Satoshi disappeared after having mined around 1.1 million Bitcoin, and these coins have never moved from their original wallets.

This gave Bitcoin its “immaculate conception”, and the project grew organically with no CEO, no company, no marketing department, nor any central control of any kind, into a world class $500B-$1T asset in just a little more than a decade…

For the first time in history…

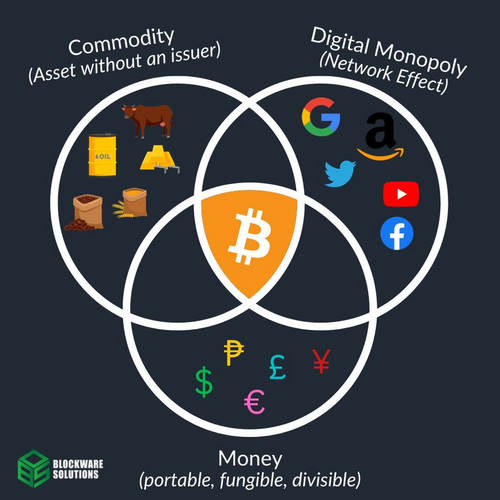

Humanity have engineered a globally monetized asset that mimics/is a commodity, and gives true property rights to 8+ billion people…

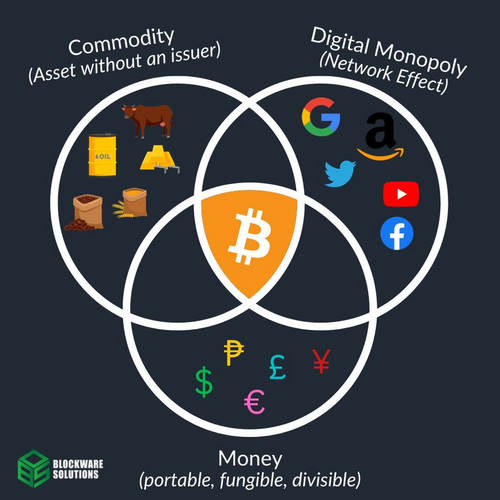

Bitcoin can be compared to both gold and real estate, while at the same time transcending both:

Gold is simply too impractical in comparison to Bitcoin, and governments, including the US, have been known to make private ownership illegal…

Crossing borders with gold is a hassle and a risk to say the least…

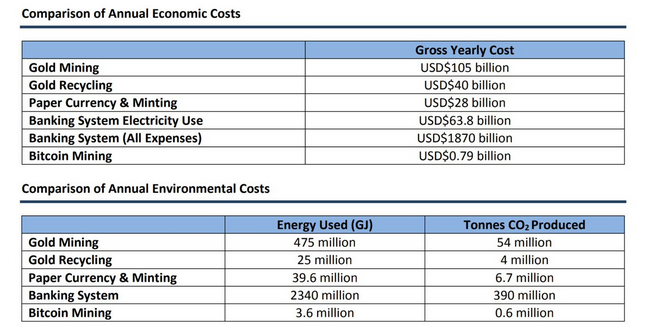

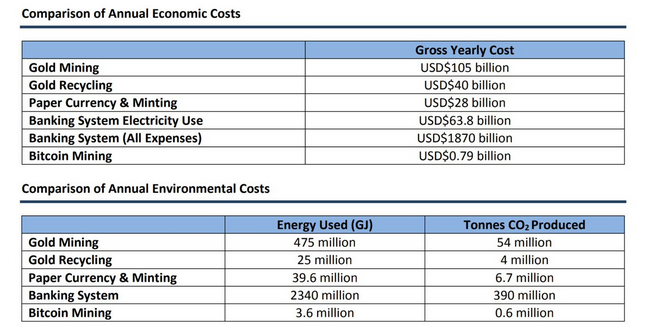

source: https://coincentral.com/what-is-the-environmental-impact-of-bitcoin-mining/

Bitcoin allows you to store your whole net worth in your head (or anywhere) by remembering 12 or 24 words.

Bitcoin is therefore the only asset you can truly own, as anything else can be taken from you either legally or illegally…

But Wait… What If The Government Tries

To Ban Bitcoin?

We saw plenty of examples of governments freezing the bank accounts of regular citizens in totalitarian ways in 2022…

In “democratic” Canada, for example…

Simply donating small amounts to the trucker protests was enough to have your bank account frozen.

Here is what happened in Nigeria when the government tried to ban Bitcoin…

source: https://www.nasdaq.com/articles/bitcoin-peer-to-peer-trading-in-nigeria-rises-27-since-central-banks-ban-2021-04-23

Government agencies have failed to stop online piracy, and they have no legal precedence to even try to stop a commodity like Bitcoin…

Besides…

The same goes for politicians, although some are more open about it than others…

And there is also…

The Satoshi Act Fund is successfully turning on State after State to the benefits of Bitcoin and Bitcoin mining…

With Bitcoin you are your own Swiss bank account, and nobody needs to know about it…

In short…

Bitcoin creates a whole new paradigm… and paradigm shifts happen gradually then suddenly…

Should I trade Bitcoin, or simply hold it?

You should probably know that…

Veteran bitcoiners never trade Bitcoin…

Or at least they trade only a small % of what they hold…

Why?

Because they…

Don’t want to risk being left on the ground holding fiat bags when this thing explodes towards the stratosphere and beyond…

When you first saw people walking around with iPhones, they were few and far between…

Then…

Suddenly everyone’s head was buried in these things….

This is known as the “100th monkey effect”:

And when the proverbial “100th monkey” gets it…

Well…

Let’s just say that it suddenly – clicks – in the mass consciousness…

And that’s the point of no return…

This is why more and more companies, institutional investors, smart money, and countries are adding Bitcoin to their balance sheet…

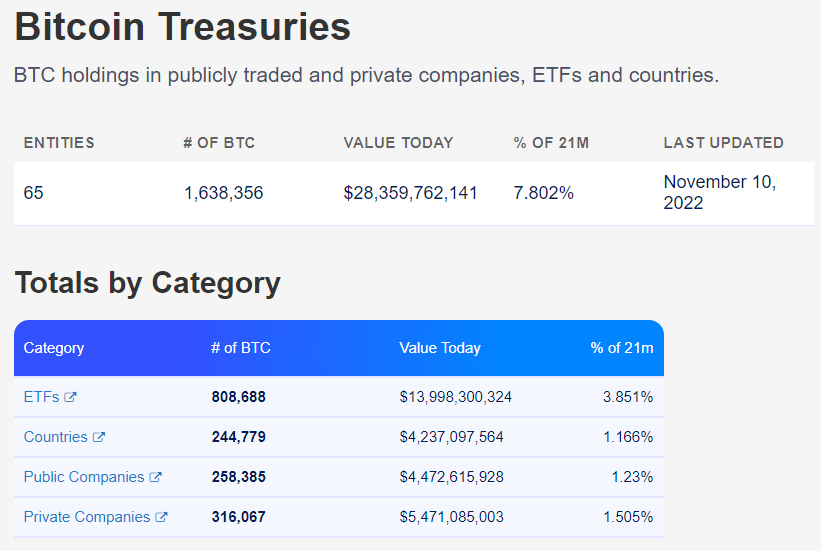

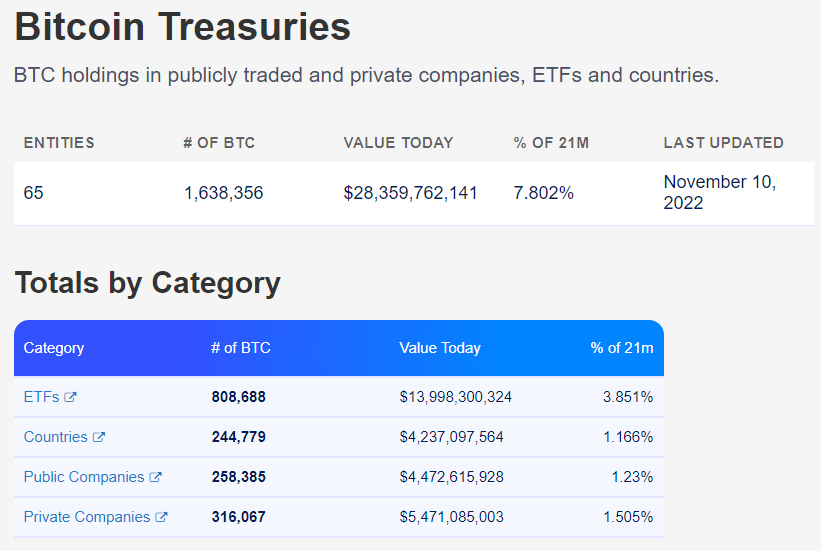

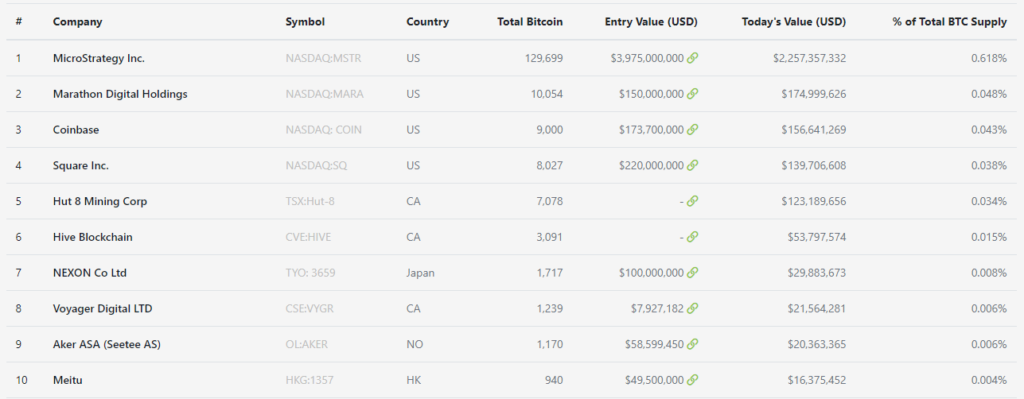

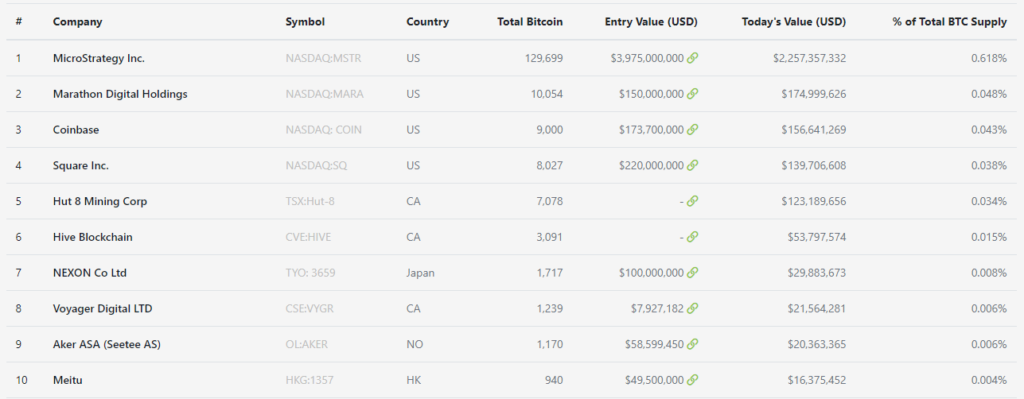

23 Public Companies, 8 Private Companies, 15 ETFs, and 5 Countries Hold 7.8 % Of All Bitcoin That Will Ever Exist In Their Treasuries (late 2022)…

El Salvador historically became the first country to make Bitcoin legal tender in late 2021…

source: https://buybitcoinworldwide.com/treasuries/ and https://www.coingecko.com/en/public-companies-bitcoin

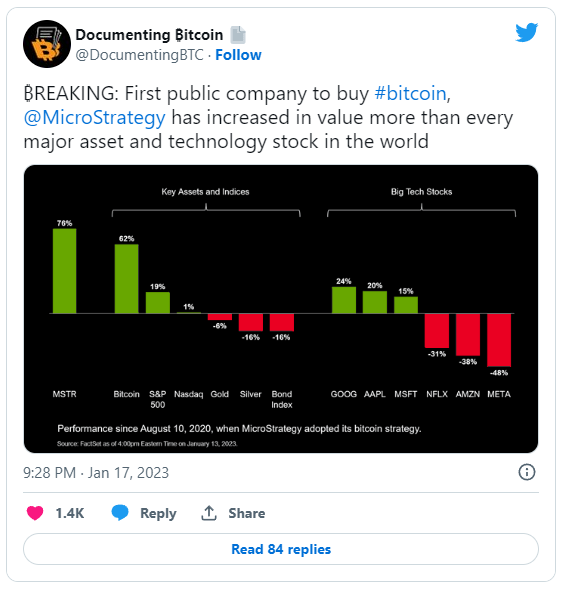

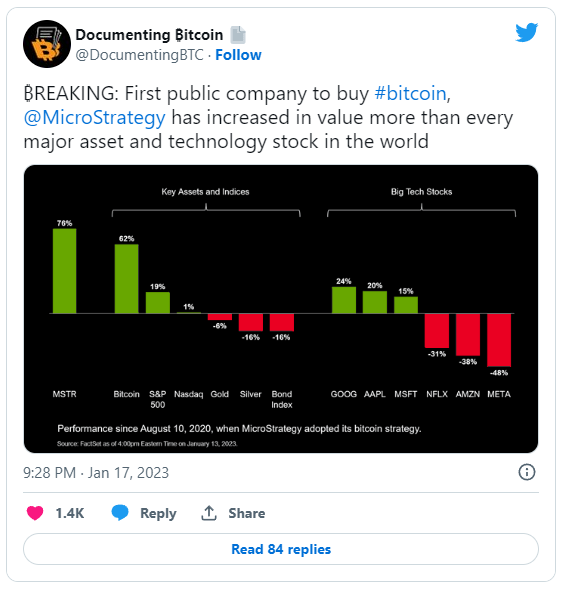

MicroStrategy was the first public company to do this, and…

Here’s how they are doing on The Bitcoin Standard in the middle of the 2022/2023 macro-economical bloodbath:

Owning Bitcoin Means You’ve Hired The Whole World To Work For Free 24/7 To Increase Your Purchasing

Power Forever…

That’s the magic of ABSOLUTE scarcity…

The true value of 1 Bitcoin equals: All the wealth that exists – and all the wealth that will ever be created – divided by 21 million units.

The “meme formula” for the true value of 1 BTC is therefore…

credit:https://konsensus.network/product/bitcoin-everything-divided-by-21-million/

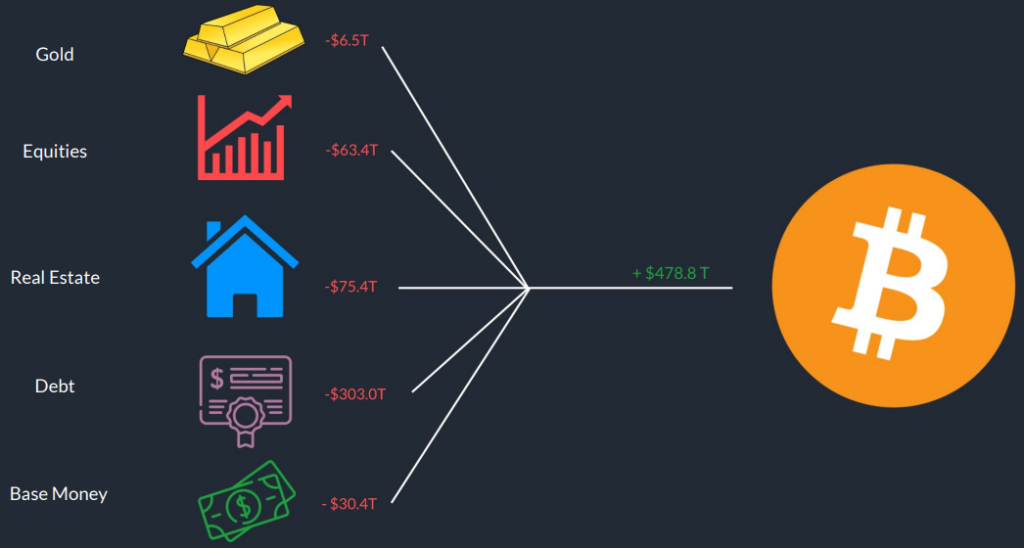

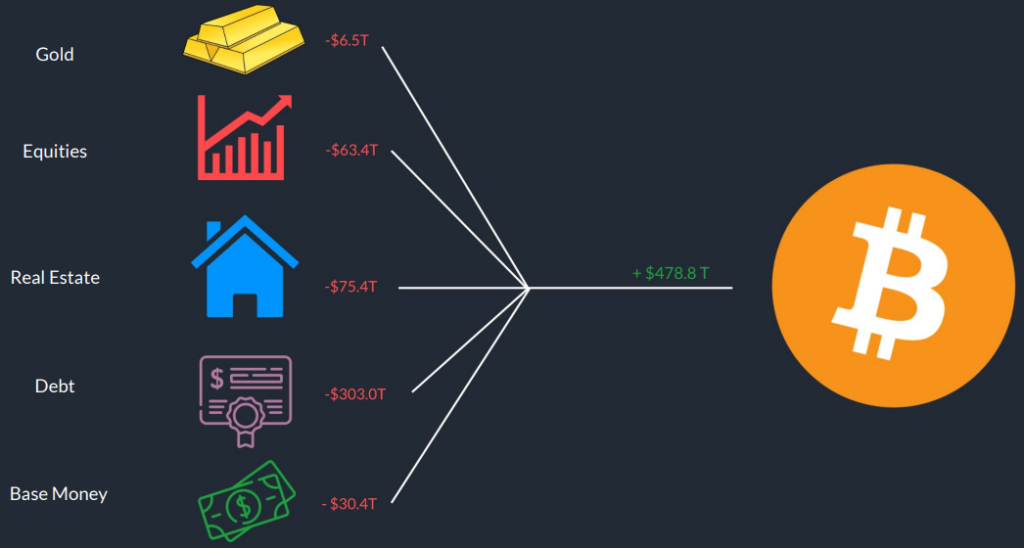

With the above meme in mind, let’s take a look at…

What owning only 1 BTC (or even just 0.1 BTC) today could mean for your future…

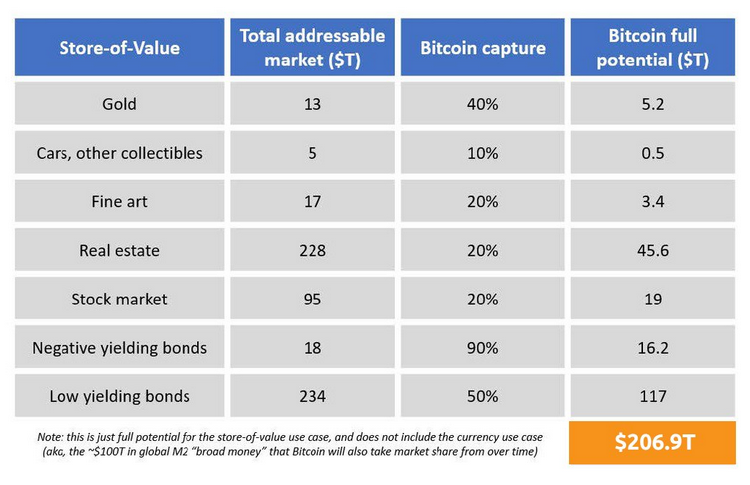

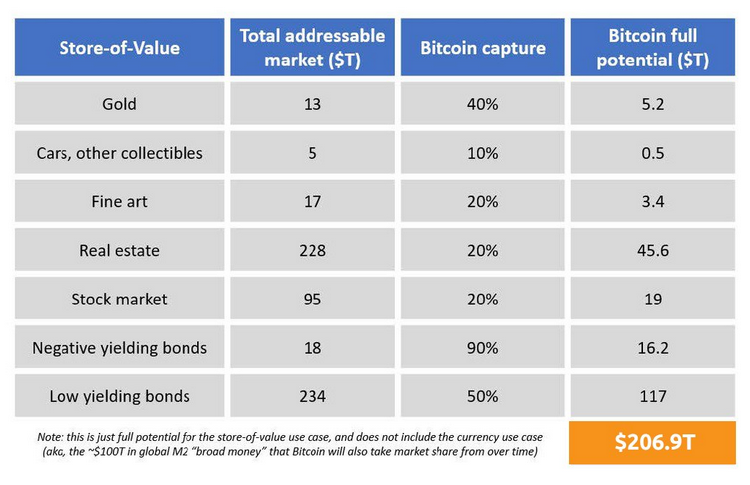

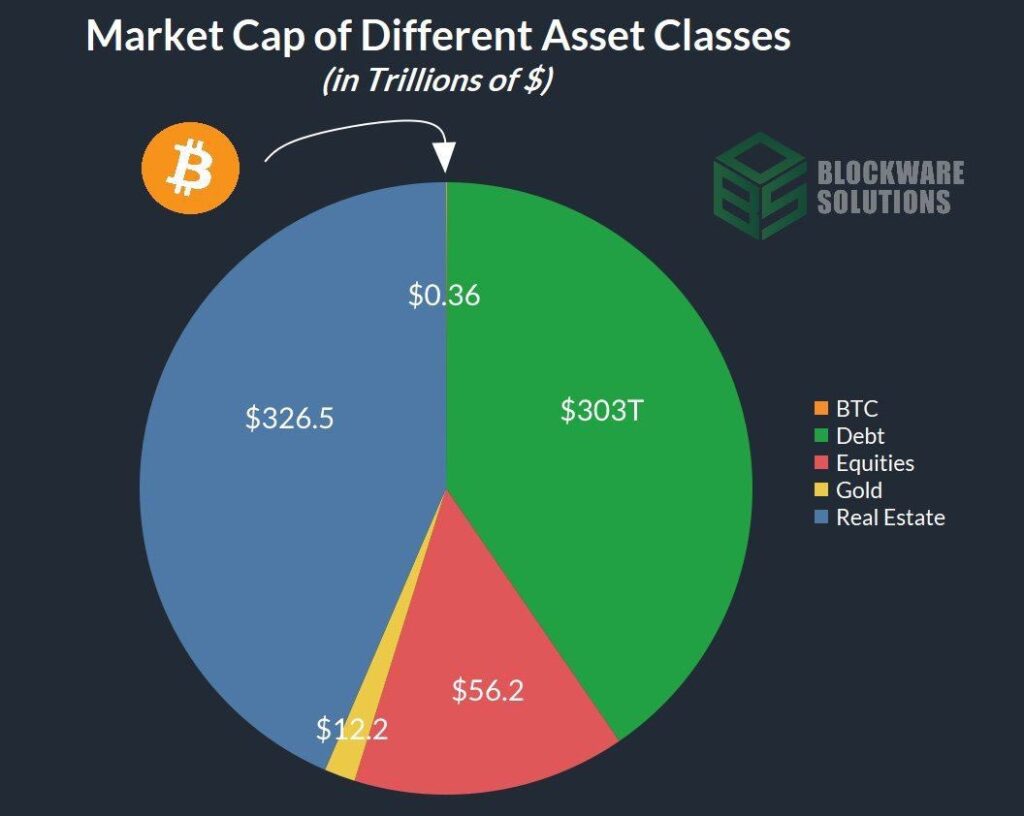

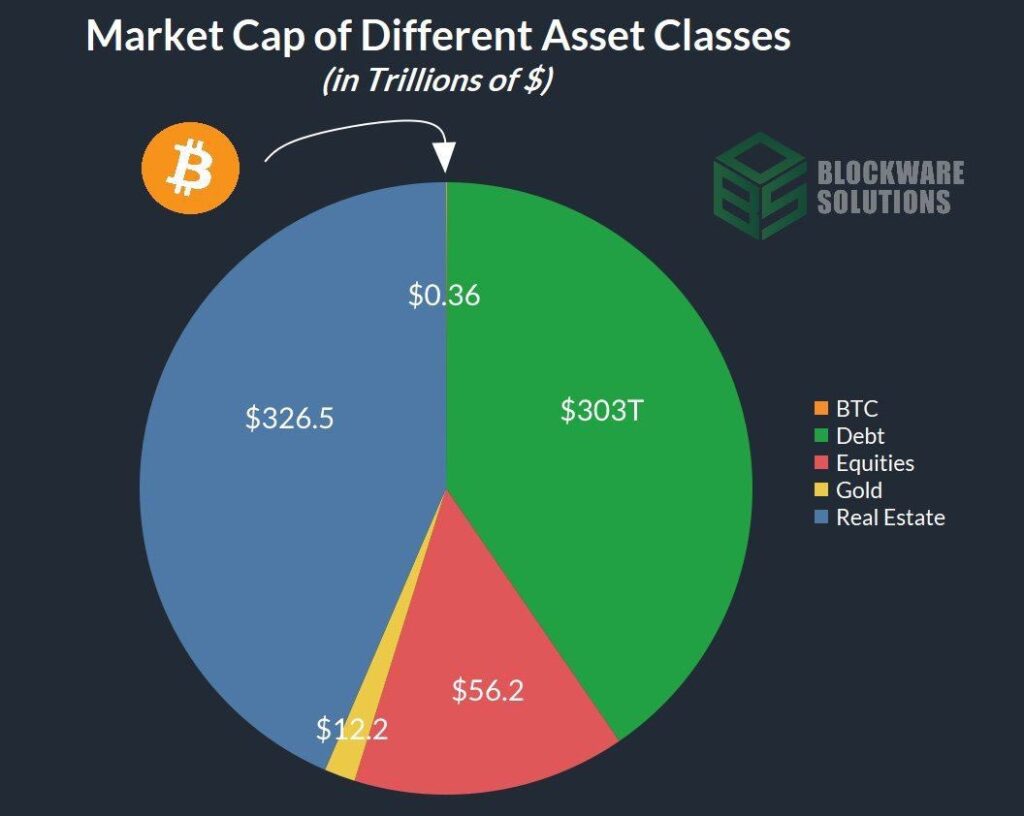

“We have estimated the total global value of financial assets to be roughly ~$780 Trillion, of which BTC currently represents ~0.05%.

After completing the demonetization of other asset classes (the monetary premium), the purchasing power of Bitcoin will comprise of roughly 61.4% of the total global market cap of financial assets. 1 BTC will have a purchasing power equivalent to ~$22,814,092, 2021 US Dollars.

The last point to note is that the purchasing power of BTC will increase in perpetuity corresponding to productivity increases. Assuming an average annual global GDP growth rate of 2%, the purchasing power of BTC will double every 36 years.“

source: https://static1.squarespace.com/static/5de588aa3e9c044c1ad8cb59/t/635fca5fe9aa570b74070a23/1667222112353/Purchasing+Power+Report.pptx.pdf

To be clear, if 1 BTC = $22,814,092…

- Holding 0.1 BTC = $2,281,409

- Holding 0.2 BTC = $4,562,818

- Holding 0.5 BTC = $11,406,546

The above is, of course, a best case scenario…

But…

Even if Bitcoin “only” goes to $1,000,000 in fiat value (less than 5% of the above estimate)…

You’re still looking at 50-70x gains relatively short term…

It’s worth repeating the above quote:

“The purchasing power of BTC will increase in perpetuity corresponding to productivity increases.”

Meanwhile…

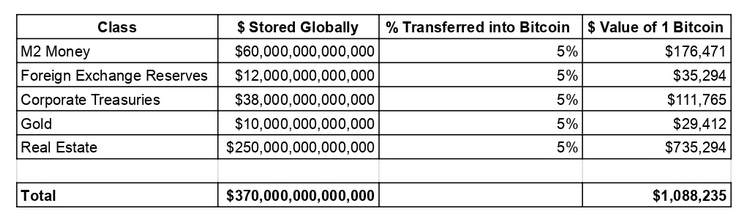

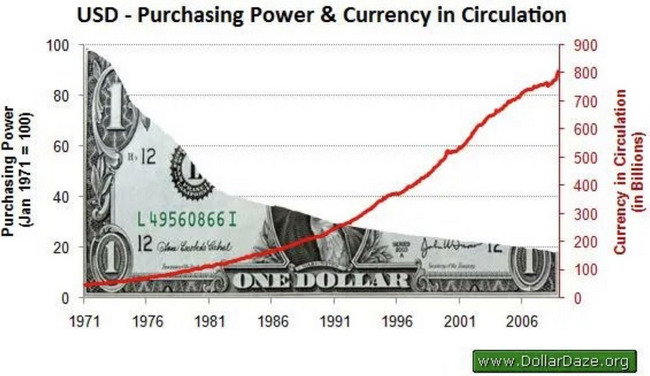

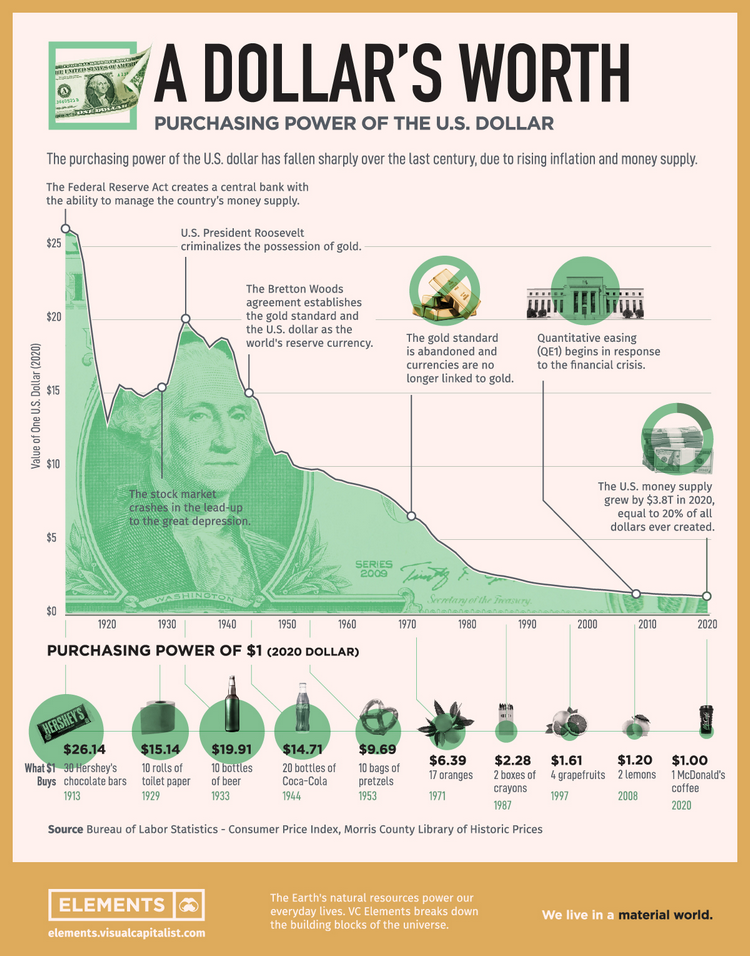

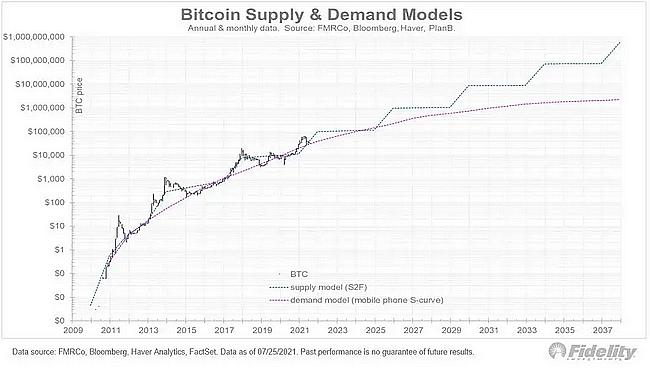

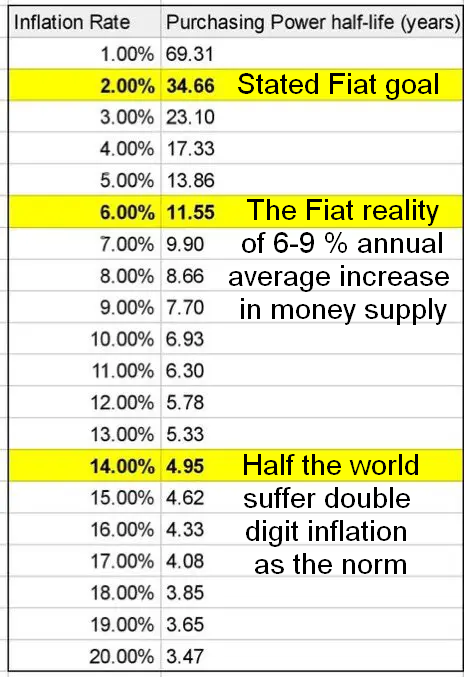

The purchasing power of fiat is trending forever towards zero…

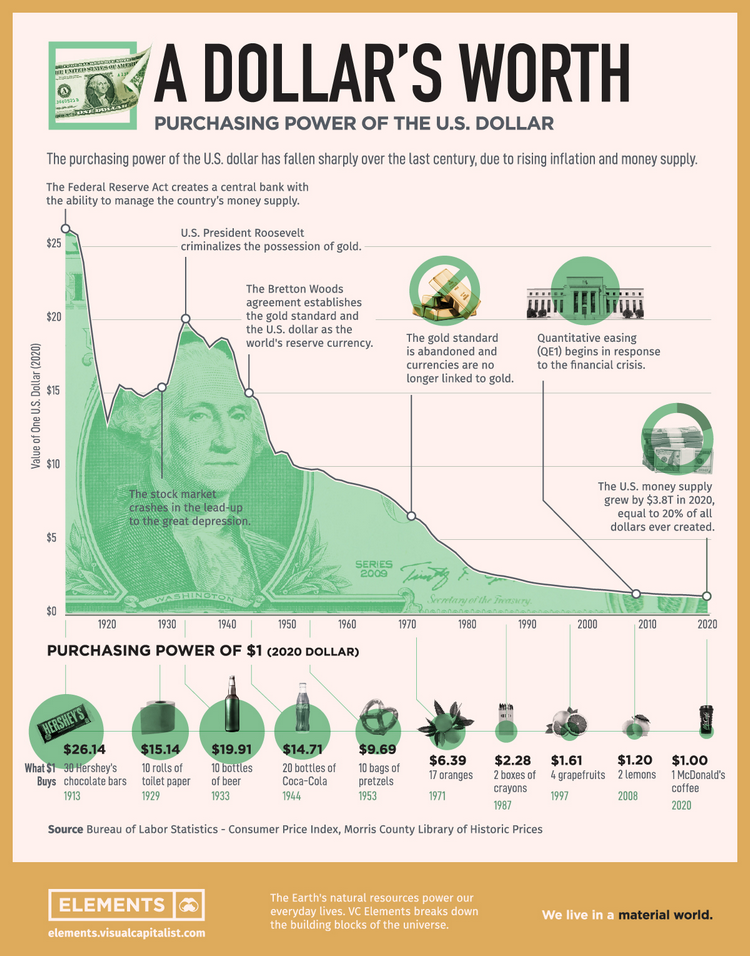

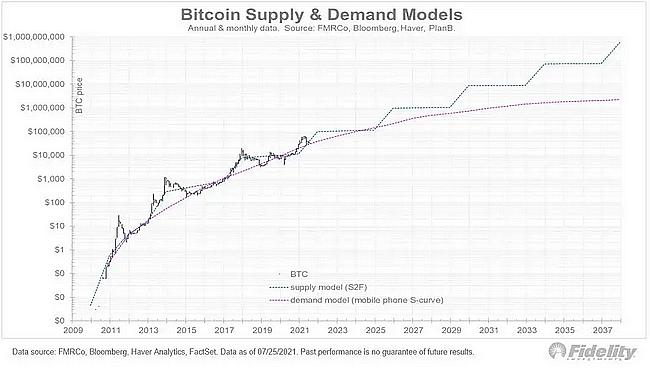

“Jurrien Timmer, Director of Global Macro at Fidelity, recently revealed a method of valuing BTC that predicts it reaching $1 billion per BTC by 2038.”

source: https://www.coinspeaker.com/bitcoin-worth-1-billion-2038-fidelity/

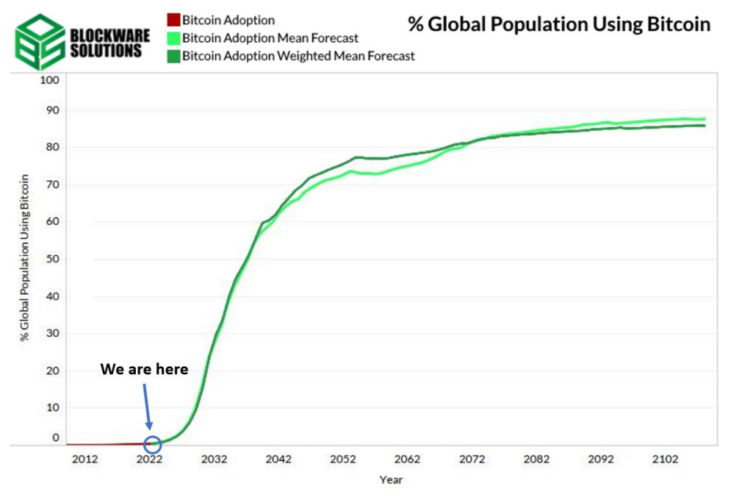

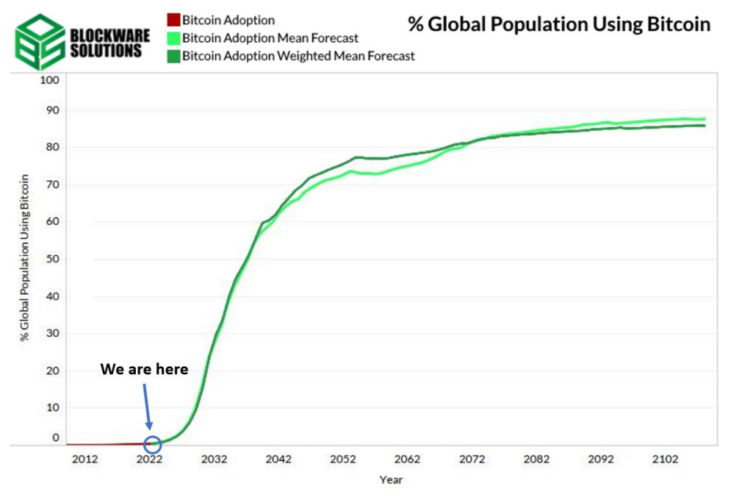

To better understand global Bitcoin adoption, you need to understand…

Why We Are Still Early In the Bitcoin Adoption Trajectory (And How That

Can Change Overnight…)

“All disruptive technologies follow a similar exponential S-curve pattern, but […] newer network-based technologies continue to be adopted much faster than the market expects.”

source: https://www.fxstreet.com/cryptocurrencies/news/bitcoin-on-track-for-mass-adoption-as-it-grows-faster-than-the-internet-202102100825

The above model does NOT take into consideration the following…

This is in accordance with “Gresham’s Law”:

“[…]The more fiat currencies are debased, the more Bitcoin (which is mathematically impossible to debase) is purchased as a long-term store of value…

source: https://tradesmithdaily.com/educational/how-greshams-law-drives-the-bitcoin-price/

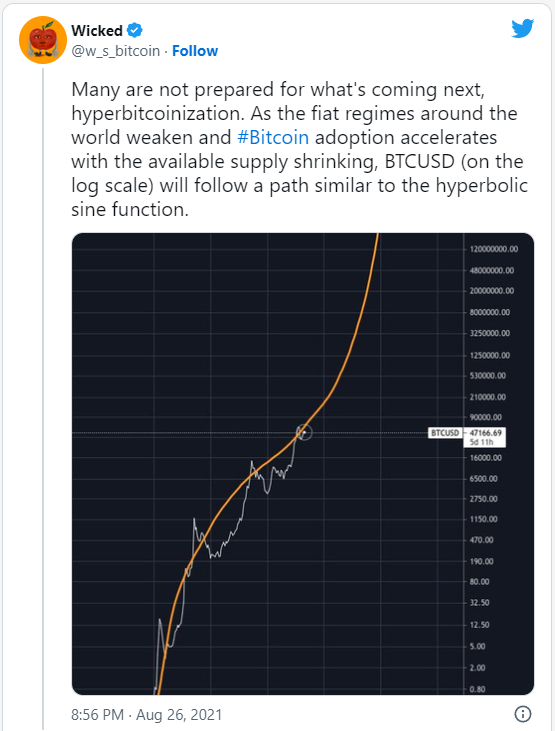

This makes Bitcoin ever more scarce, which leads us towards…

The Day Of Hyperbitcoinization…

In this hyperinflationary macro-environment, it’s hard to tell when the proverbial 100th monkey “gets it”…

Global adoption will be further boosted by the…

Highly underestimated fact that Bitcoin solves major real-world problems…

7 Major Real-World Problems That ONLY Bitcoin Can – And Already Is – Fixing…

The value of Bitcoin can be measured in the number and size of the problems it solves…

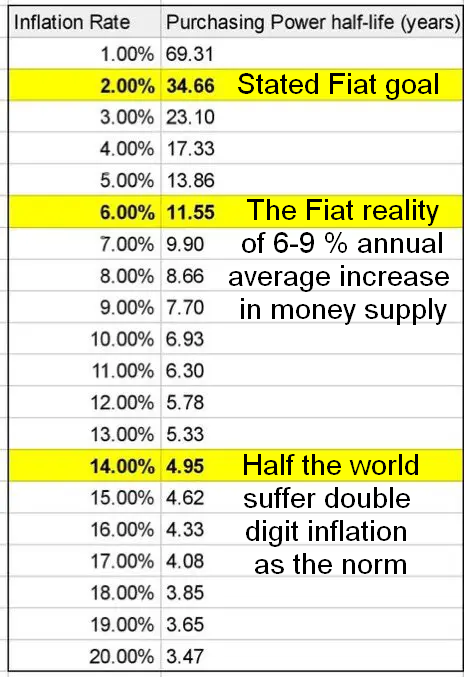

#1 Bitcoin STOPS your money from stealing from you (while freeing you from debt slavery)…

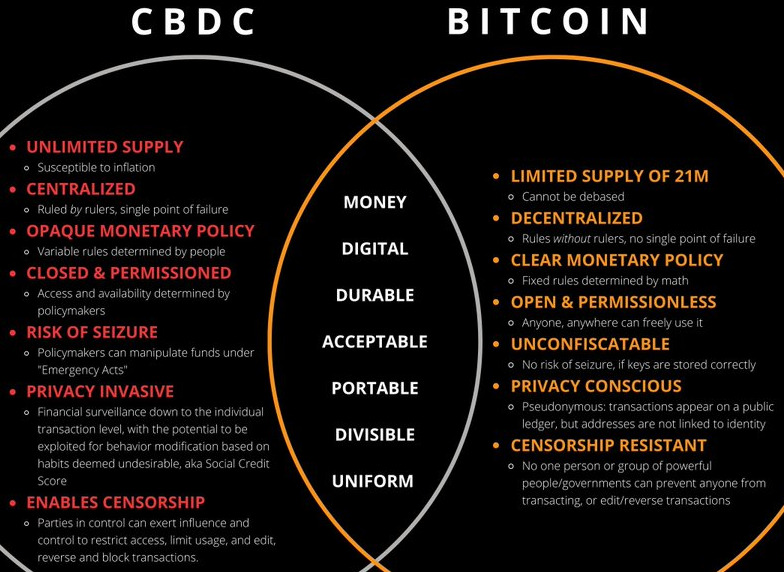

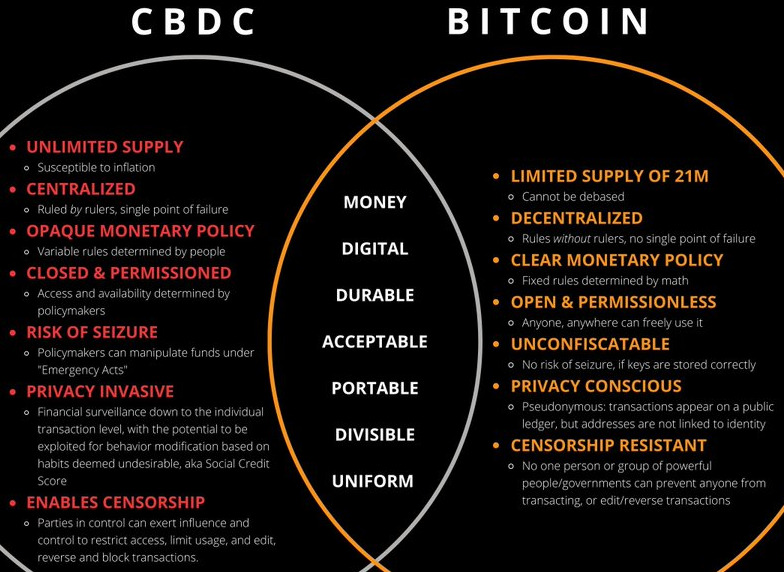

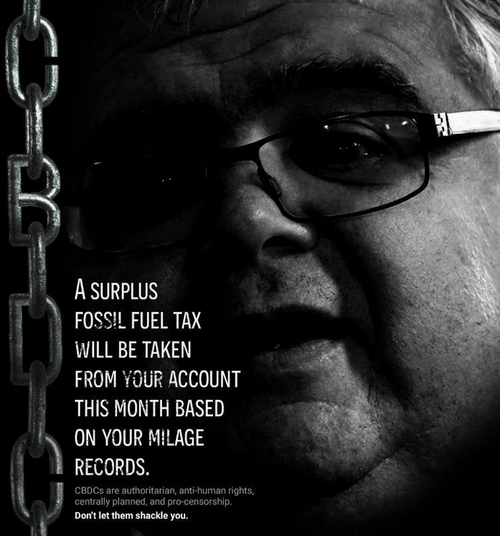

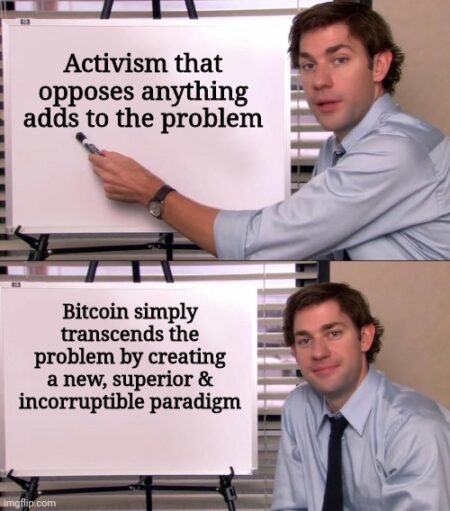

#2 Bitcoin is our ONLY peaceful and effective countermeasure to CBDC tyranny…

Remember…

The Bitcoin Paradigm/Standard does not oppose, it transcends…

What you resist tends to persist…

With Bitcoin, we are simply opting in to something more beneficial instead…

Around 70-80% of the world population lives under oppressive regimes, and many are struggling in the quicksand of double-digit inflation…

Bitcoin demand from the Global South will only increase as the word is spreading, and many in the West will arrive late to the party.

MUST WATCH: 5-minute video on why Bitcoin is freedom money for the entire planet

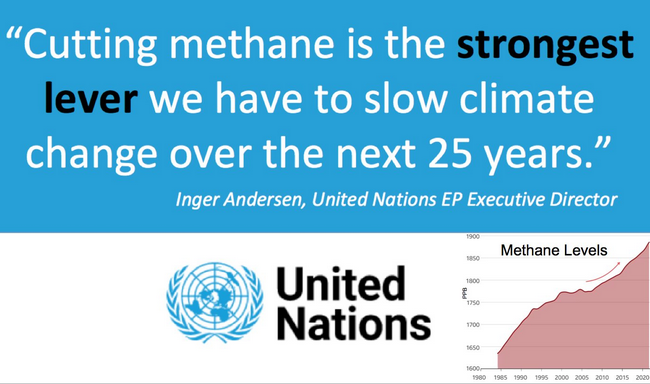

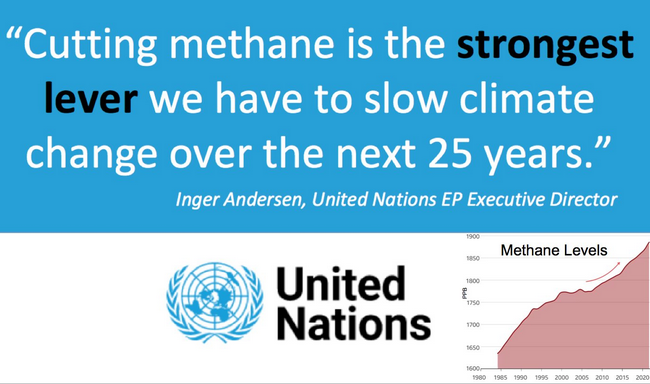

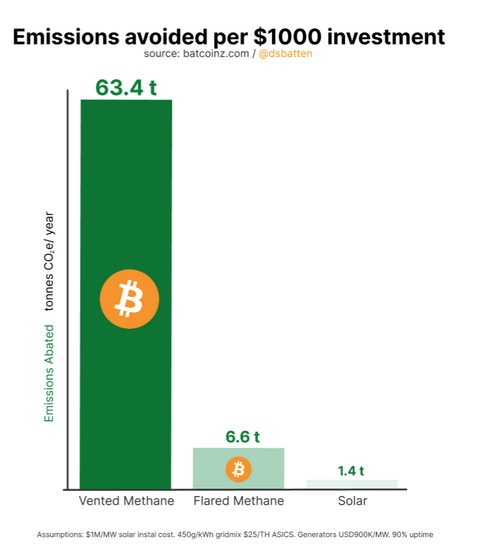

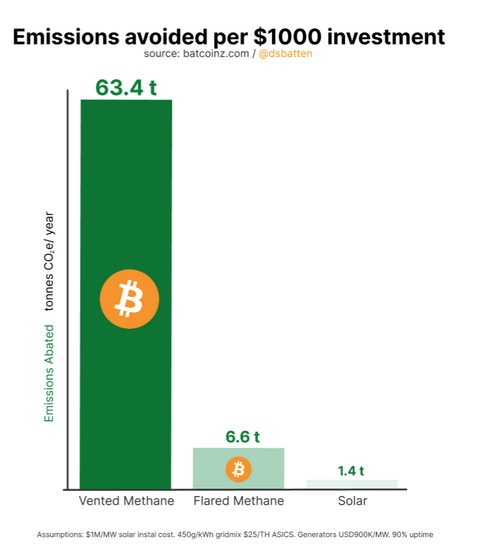

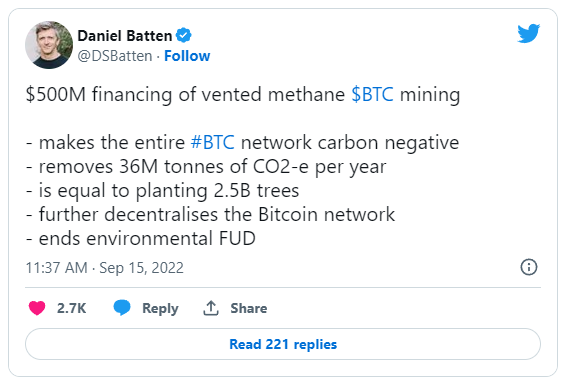

#3 Bitcoin is on track to become carbon negative (and it’s a CO2-removing godsend for those who believe CO2 is a problem)…

In the words of ESG Analyst and Environmentalist, Daniel Batten:

#Bitcoin mining reduces the CO2-equivalent emissions by about 63% when compared to traditional methods of flaring methane, says @GigaEnergy_ pic.twitter.com/E4QTrbN4x7

— Documenting ₿itcoin 📄 (@DocumentingBTC) March 17, 2022

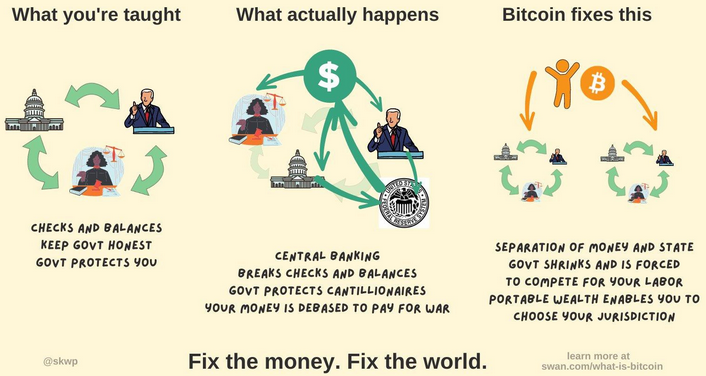

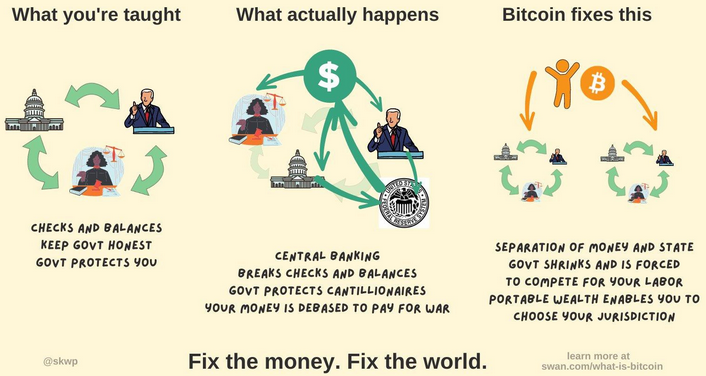

#4 The Fiat System incentives big government waste and war (Bitcoin fixes this!)…

“Fiat money allow wars with no real cost to governments, which is why the century of central banking was the century of total war…”

“Under hard money, governments fought till they ran out of their own money. Under easy money, governments can fight until they completely consume the value of all the money held by their people,” wrote Ammous, a member of the Center on Capitalism and Society at Columbia University.

source: https://www.rt.com/business/452445-fiat-hard-money-wars/

Governments do this by printing as much money as they want/need, which forces the inflationary “tax” on you and me (i.e. the people) down the road…

War would be much less popular amongst people if the true cost came up front in the form of severely increased taxes.

Hence, a Bitcoin Standard world of hard money disincentivizes big government, waste, and war…

In fact, the main reason the world went off the Gold Standard was precisely to keep financing wars:

France, Russia, Germany, and Austria-Hungary chose to abandon the gold standard, either to obtain the flexibility to fight the war more effectively or because they were economically too weak to mobilize militarily while remaining on gold. (source: https://encyclopedia.1914-1918-online.net/article/war_finance)

World War I effectively ended the real international gold standard. (source: https://www.britannica.com/topic/money/The-decline-of-gold)

Starting in the 1959–1969 administration of President Charles de Gaulle and continuing until 1970, France reduced its dollar reserves, exchanging them for gold at the official exchange rate, reducing U.S. economic influence.

This, along with the fiscal strain of federal expenditures for the Vietnam War and persistent balance of payments deficits, led U.S. President Richard Nixon to end international convertibility of the U.S. dollar to gold on August 15, 1971 (the “Nixon Shock”). (source: https://en.wikipedia.org/wiki/Gold_standard)

Infographic: How Bitcoin Reduces The “Return On Investment” of War

source: https://www.amazon.com/dp/B0BW358F37

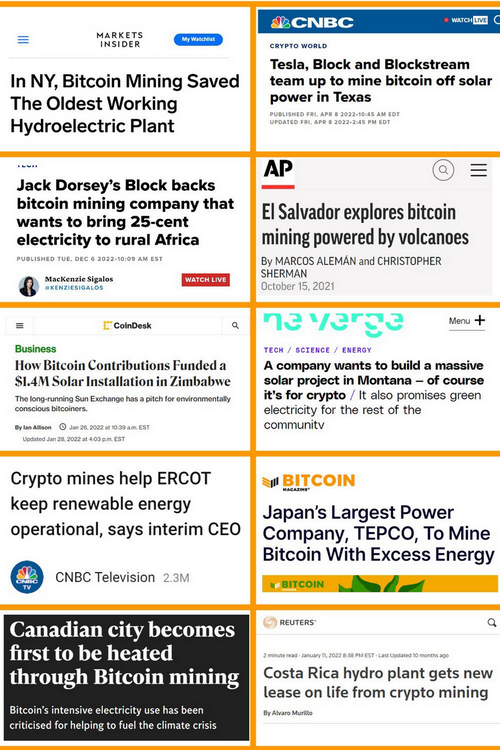

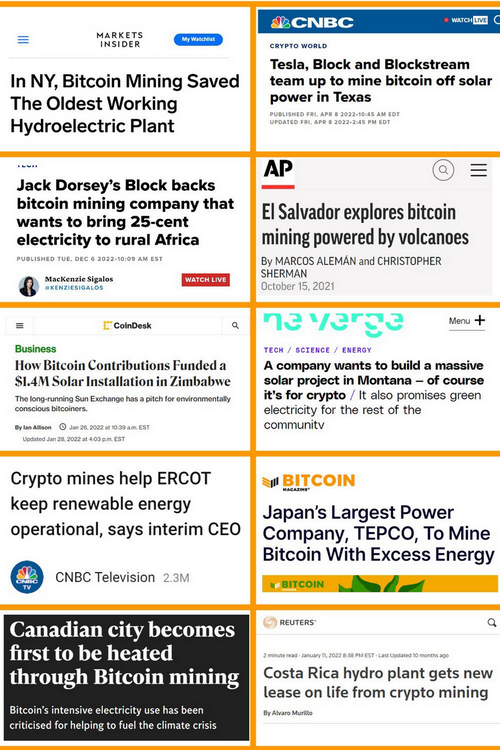

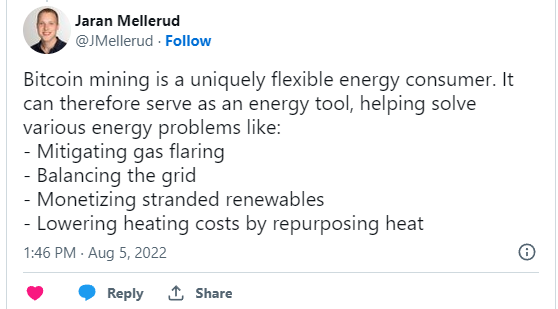

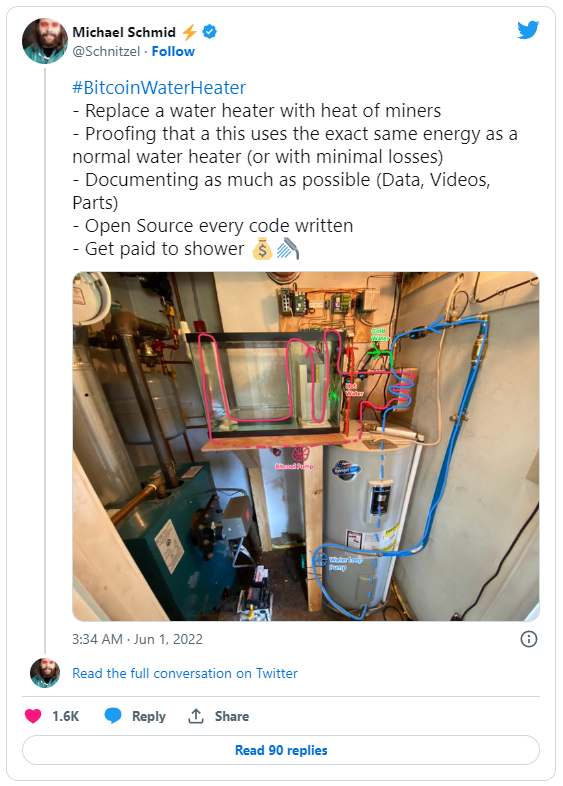

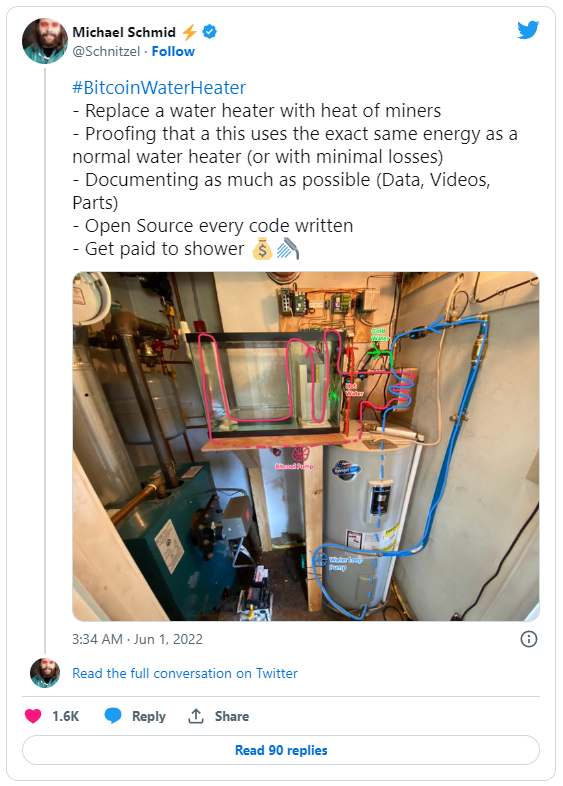

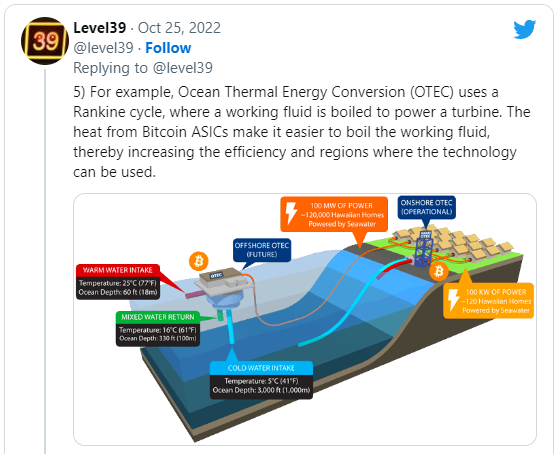

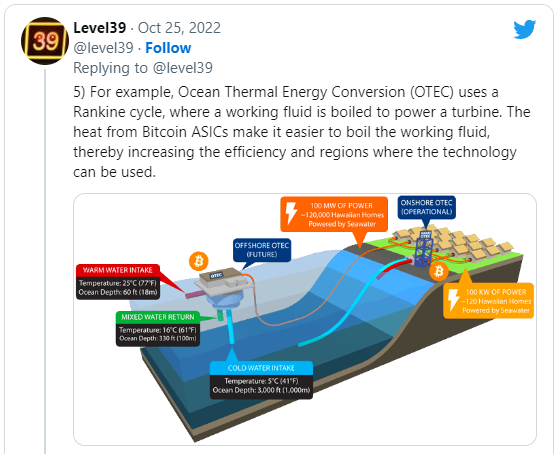

#5 Bitcoin mining is revolutionizing the energy industry in multiple ways (including using excess heat from Bitcoin mining in creative ways)…

Warming Up to Bitcoin – The Future of Sustainable Heating (9-min. video):

Watch this video on YouTube

source: https://braiins.com/blog/guide-home-hvac-heating-bitcoin-mining

Watch this video on YouTube

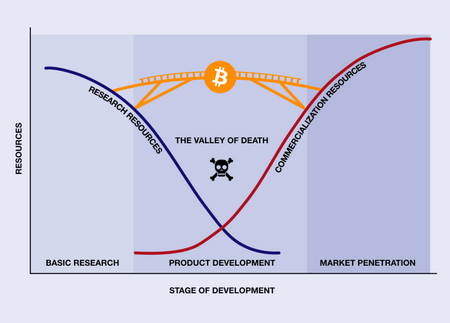

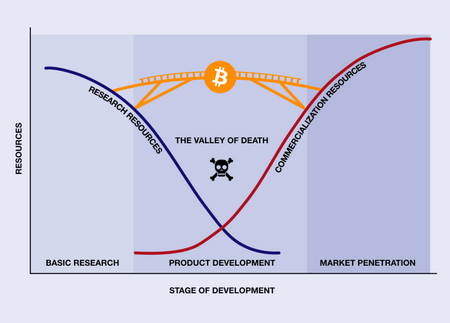

#6 Bitcoin helps scale renewable energy innovations (by bridging the innovation

valley of death)…

Startup companies can make money from Bitcoin mining while scaling their innovation, and the heat from mining can be reintegrated into the system.

source: https://twitter.com/level39/status/1584753373051752448

#7 Bitcoin solves the problem of spam and cyberspace attacks…

Bitcoin is already defeating email spam (see below), and there are endless similar use cases…

source: https://www.amazon.com/dp/B0BW358F37

Lowery provides an argument for why emerging proof-of-work technologies (namely Bitcoin) will have a dramatic impact on how humans organize, cooperate, and compete on a global scale by empowering populations to project physical power in, from, and through cyberspace.

Major Lowery concludes that Bitcoin represents a national strategic imperative that the US should support and adopt as quickly as possible, else it risks losing its lead as a global superpower in the 21st century.

source: https://www.reacher.me/

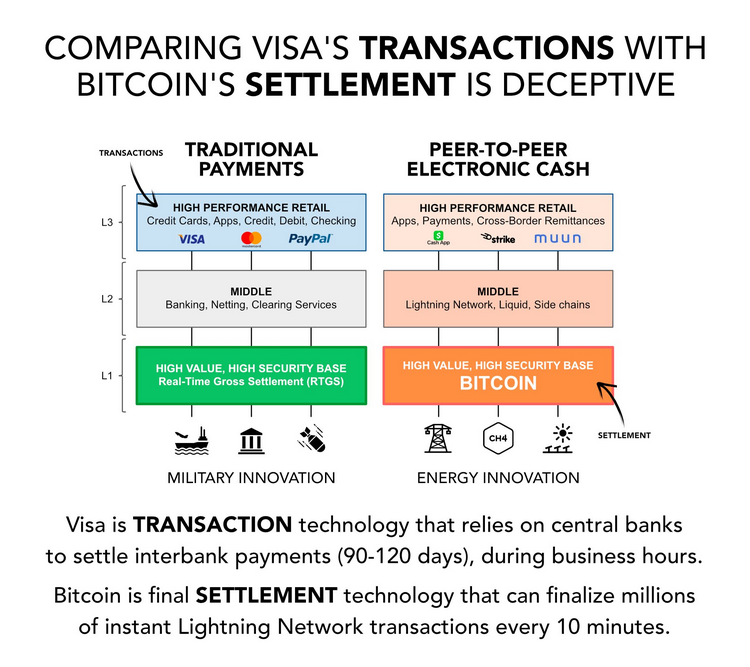

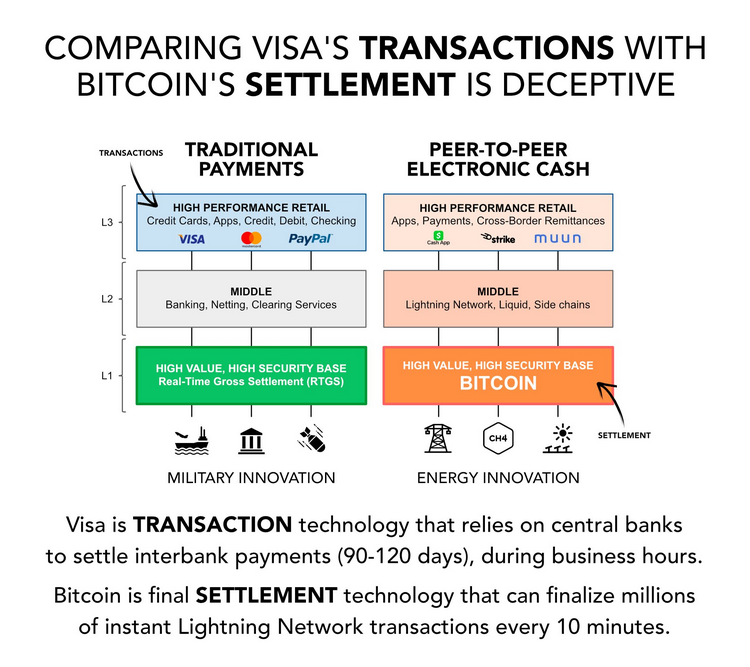

Bitcoin’s Lightning Layer Allows For Millions of Transactions (Beats Visa And Legacy Banking Rails On All Fronts)…

The fallacious “Energy Per Transaction” metric is debunked by the below:

When the world catches on to how many problems Bitcoin solves…

Well, let’s just say $1M per BTC seems severely undervalued…

As you’re now beginning to understand…

Bitcoin Is So Much More Than Just The Investment Opportunity Of A Lifetime…

We can probably all agree that a life that’s ONLY about chasing money isn’t really fulfilling…

Fixing the broken monetary system of the world, however, is a worthwhile mission that gives purpose and meaning…

The first time you take ownership of Bitcoin, it feels like your money has finally arrived home.

Each fiat-to-Bitcoin conversion that follows is like bricks being removed from your shoulders.

Bitcoin gives you a foundation to build on, as well as a strong sense of purpose.

You become part of a global community of like-minded, optimistic people busy building this new paradigm for economic freedom.

Even more importantly…

Bitcoin gives you a persistently constructive focus in your life…

What appeals to so many people, whether consciously or not…

Is the fact that…

Instead of endlessly doom-scrolling “the problem”, YOU become an ACTIVE participant in the emerging

fundamental solution…

Many people get stuck on endlessly studying (and being victimized by);

“the problem”…

Bitcoin answers the age old question:

“But what can we DO about it?”…

By simply becoming a Bitcoin owner…

You’re building the new freedom paradigm – brick by brick – block by block…

You are also building your own future, and the future of your family…

Bitcoin is a companion, a lifestyle, a friend, a partner, a teacher, a mentor, and a harsh mistress at times…

It puts the spark back in people’s eyes, and ignites that long forgotten hope in your heart that you probably had growing up…

The hope for a better world – a better tomorrow – for both ourselves, our kids, and our grandkids…

Owning Bitcoin gives you a long-term perspective, which paradoxically allows you to relax and enjoy the moment more…

It makes you feel like you’re part of something of historical significance…

Ultimately, Bitcoin is a vote for a better future for yourself, your children, and humanity as such…

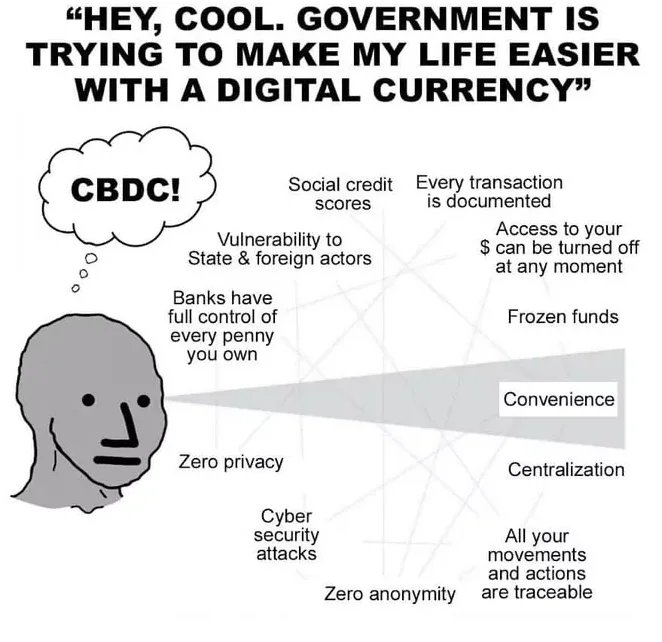

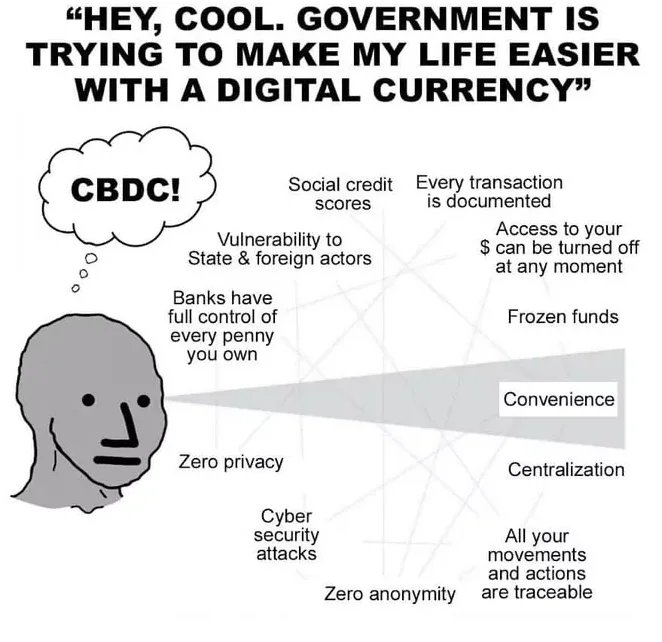

There are 4 paradigms playing out right now, and the choice is yours…

- The fiat paradigm means a shadowy group of “elite bankers” have the money printer (and can manipulate the economy as they see fit).

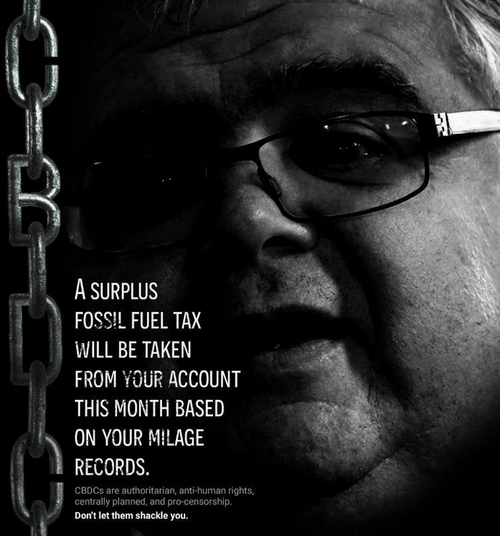

- The central bank digital currency (cbdc) paradigm (fiat 2.0) enables total monetary surveillance and denial-of-service tyranny ala China.

- The “altcoin” paradigm gives every scammer in the world a money printer they can use to rug-pull retail by pretending to be “Bitcoin 2.0”.

- The Bitcoin Paradigm/Standard means nobody controls the money printer, and the issuance policy is 100% predictable and immutable.

The below meme illustrates what CBDC tyranny looks like…

Bitcoin separates Money and State, which is about as significant as the separation of Church and State…

Bitcoin serves the people, and the people serve Bitcoin, in a healthy symbiotic relationship.

Fiat serves government/banker insiders close to the money printer, and to the monetary policy decisions, while taxing the people via endless inflation.

As you’re now beginning to understand, Bitcoin is about so much more than just short-term fiat gain…

Bitcoin is a stealthy, paradigm-upgrading revolution for a better world for all of mankind…

The time has come to ask yourself…

Can You Really Afford The Risk Of NOT Owning Any Of The Only Absolute

Scarce Asset That Can Ever Exist…

You now understand Bitcoin – and the coming paradigm shift – better than 98% of the population…

You’ve seen…

- How absolute scarce and deflationary Bitcoin will rise forever against endlessly debasing fiat (even if demand remains constant)…

- Why Bitcoin has limited downside risk due to a rapidly growing group of fanatical holders/buyers of last resort…

- Why there is no viable alternative to Bitcoin (as “alts” are centralized unregistered securities)…

- How Bitcoin transmutes short-term greed into honest altruism (that can scale to 8B+ people)…

- Why Bitcoin represents a once-in-a-civilization early-bird opportunity (until hyperbitcoinization)…

- How Bitcoin is moving humanity towards a paradigm shift (gradually, then suddenly)…

- How more and more companies, institutions, smart money, and countries are hoarding Bitcoin…

- Why owning Bitcoin equals the whole world working for free 24/7 to increase your wealth (∞/21m)…

- How Bitcoin fixes 7+ major real world problems (in ways 98% have no clue about – yet)…

- How becoming a bitcoiner helps building the new freedom paradigm that transcends CBDC tyranny…

This puts you way ahead of the curve, which is akin to having “insider knowledge” (albeit fully legal).

Below is a 1:46 video of Mexico’s 3rd wealthiest man, Don Ricardo Salinas Pliego, explaining…

Why all fiat currencies are a fraud, and why he prefers to hold bitcoin over the next 30 years.

Possessing knowledge is well and good, but true change is measured in change of behavior…

Just like Neo, you cannot really see the fiat-matrix until you’re unplugged from it…

Taking ownership of Bitcoin by converting some of your constantly debasing fiat equals taking the orange pill:

Also keep in mind that…

Bitcoin self-custody is a crucial skill to possess before CBDCs starts to roll out…

This Masterclass has given you a solid overview, but you’re still looking at Bitcoin from the outside…

Once you truly get Bitcoin, you will find yourself producing posts like this:

WARNING: Bitcoin Is NOT For Those Who Cannot Handle A Long-Term Commitment…

As we’ve seen…

Bitcoin is still volatile in terms of fiat value, and it’s therefore not for the faint of heart.

A good rule of thumb is to…

Have at least a 4-year perspective, and think of Bitcoin as your long-term savings account (and even pension fund).

This harmonizes with the mining reward (issuance of new BTC) being cut in half every 4 years, which makes Bitcoin ever more scarce…

Holding Bitcoin for your newborn baby, or your kids, might also be a good idea, as a little bit goes a long way in 18 years…

Here’s the good news…

You don’t have to go “all in” to experience the life-changing effects of becoming a bitcoiner, and even a $20 conversion to Bitcoin will get you started…

Saving a little bit per paycheck goes a long way, and…

Your future self will be grateful for the extra time and money you provided…

We have already seen that…

- People who save in Bitcoin tend to be calm and optimistic about the future…

- Bitcoin has a life-changing effect on those who wholeheartedly embrace it…

- Owning as little as 0.1 BTC can equal up to $2,281,409 post hyperbitcoinization…

Speculation on future value is not really important at this point, however…

Experiencing how empowering being your own “Swiss bank” feels – and getting comfortable with it – is what matters now…

Luckily, there is a FREE service that will ease you into the Bitcoin Standard at a pace you are comfortable with…

That’s right, this US-based company will:

- Tailor-suit a Bitcoin self-custody setup according to your preference.

- Answer any questions, and point you to the best free Bitcoin resources.

- Give you $10 worth of Bitcoin for free (when you sign up via the link below)…

Sign Up Via This Link To Get $10

Worth Of Bitcoin For Free…

For bottom-scrollers who don’t want to read (or anyone else): The presentation below sums it all up nicely in 30 minutes. It’s called The Future Of Bitcoin (recorded in mid 2023):

The content on this page is for informational and educational purposes only and should not be considered financial advice. Copyright ©